But despite all of this innovation, one essential fact remains unchanged:

Human economic life does not operate in seconds.

It operates in months.

Monthly income.

Monthly rent.

Monthly energy bills.

Monthly budgeting.

Monthly stability.

This monthly rhythm defines real-world economic behavior — yet it is almost entirely missing from the digital-asset landscape.

This article examines why crypto lacks this layer, why it matters, and how a Hybrid Stability Token introduces a model aligned with real human economic cycles.

1️⃣ The Gap Nobody Talks About

Digital assets function on high-frequency dynamics:

- second-by-second volatility

- live market repricing

- continuous liquidity movements

- real-time execution

Meanwhile, real life is structured around predictable monthly cycles.

This mismatch creates a structural disconnect between digital finance and everyday economic reality.

2️⃣ Bitcoin: A Store of Value, Not a Monthly Asset

Bitcoin excels as a long-term store of value:

- scarce

- independent

- protected against inflation

- globally accessible

But its volatility makes it unsuitable for monthly financial planning. Sharp movements within days or weeks make it impractical for recurring monthly obligations like rent, utilities, or fixed expenses.

Bitcoin works for long horizons, not for monthly stability.

3️⃣ Smart-Contract Platforms: High Utility, Low Monthly Predictability

Ethereum and other smart-contract platforms have transformed digital economies:

- tokenization

- DeFi

- NFTs

- real-world asset integration

But their native assets remain volatile.

They provide infrastructure — not monthly financial alignment.

The technology is advanced, but the price behavior does not match monthly human cycles.

4️⃣ Privacy and Speed Coins: Strong Features, Unstable Rhythm

Fast and private networks offer technical advantages.

But they still move according to speculative cycles, not monthly economic cycles.

Speed solves efficiency.

It does not solve predictability.

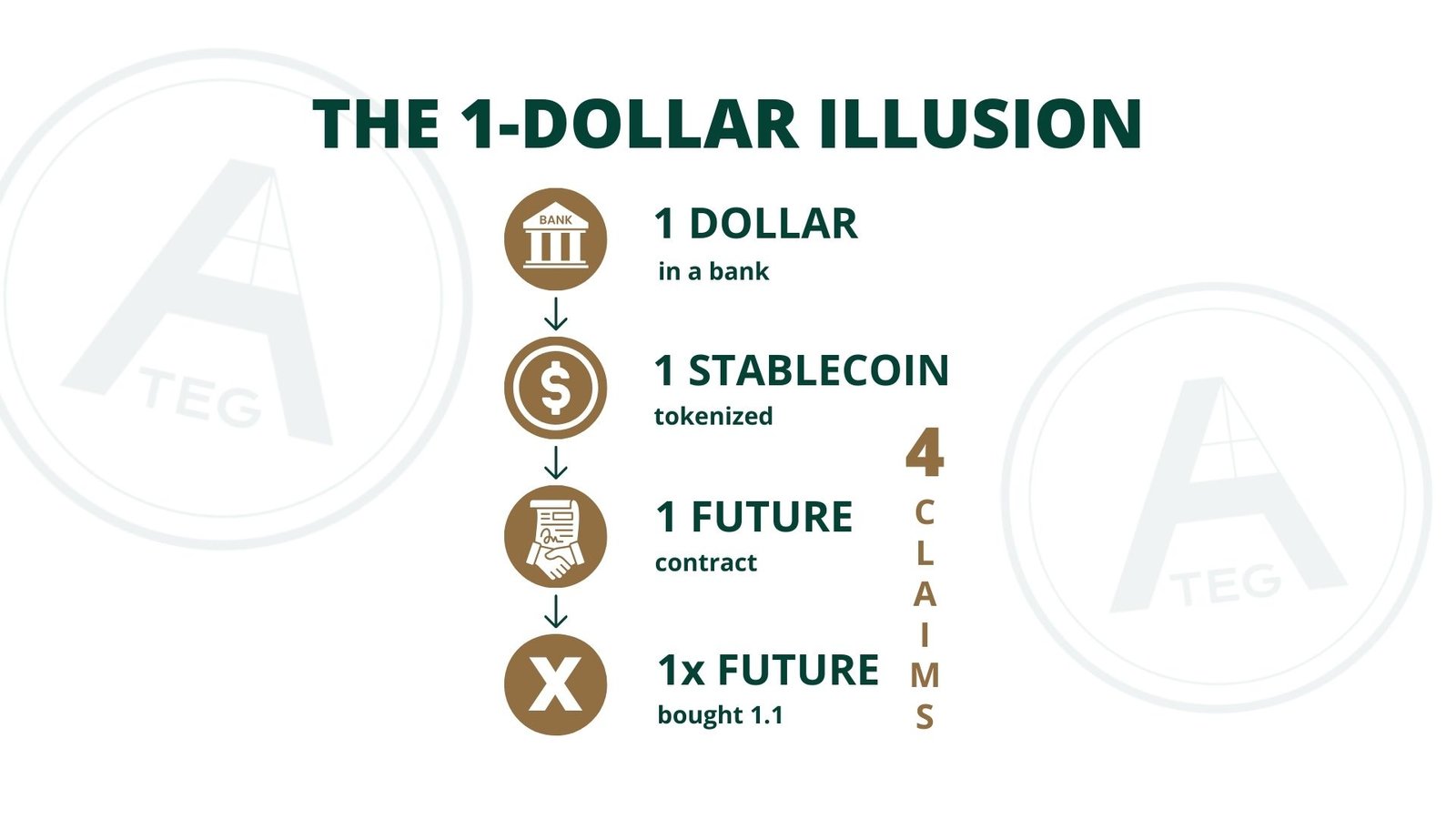

5️⃣ Stablecoins: Built for Hedging, Not for Monthly Living

Stablecoins represent one of the most important innovations in crypto. They enable:

- instant hedging during market volatility

- stable settlement across exchanges

- efficient global payments

- liquidity movement without price exposure

Stablecoins are excellent for hedging and short-term stability.

But they do not align with monthly economic behavior:

- they eliminate volatility completely

- they provide no opportunity for price improvement

- they do not operate with a monthly economic reference

- they were not designed for budgeting or long-term planning

Stablecoins stabilize price — but not economic rhythm.

6️⃣ Humans Live in Monthly Cycles — Not in Seconds

People:

- receive salary monthly

- pay rent monthly

- pay electricity monthly

- manage savings monthly

- evaluate financial stress monthly

Human financial life is monthly by design.

Crypto markets are instant by design.

This is the missing layer.

7️⃣ The Missing Layer: A Monthly Stability Mechanism

The industry has improved:

- scalability

- throughput

- collateral models

- settlement systems

- decentralized infrastructure

But none of these innovations introduce a mechanism that reflects how people actually experience economic life.

A digital economy becomes useful only when it aligns with monthly human behavior.

8️⃣ Hybrid Stability Token (HST): A Monthly-Aligned Economic Model

A Hybrid Stability Token introduces a new dimension:

It synchronizes digital asset behavior with the monthly rhythm of real-world economics.

Its structure is built around:

- Monthly Real Value Index

A monthly middle point reflecting average market behavior rather than short-term volatility.

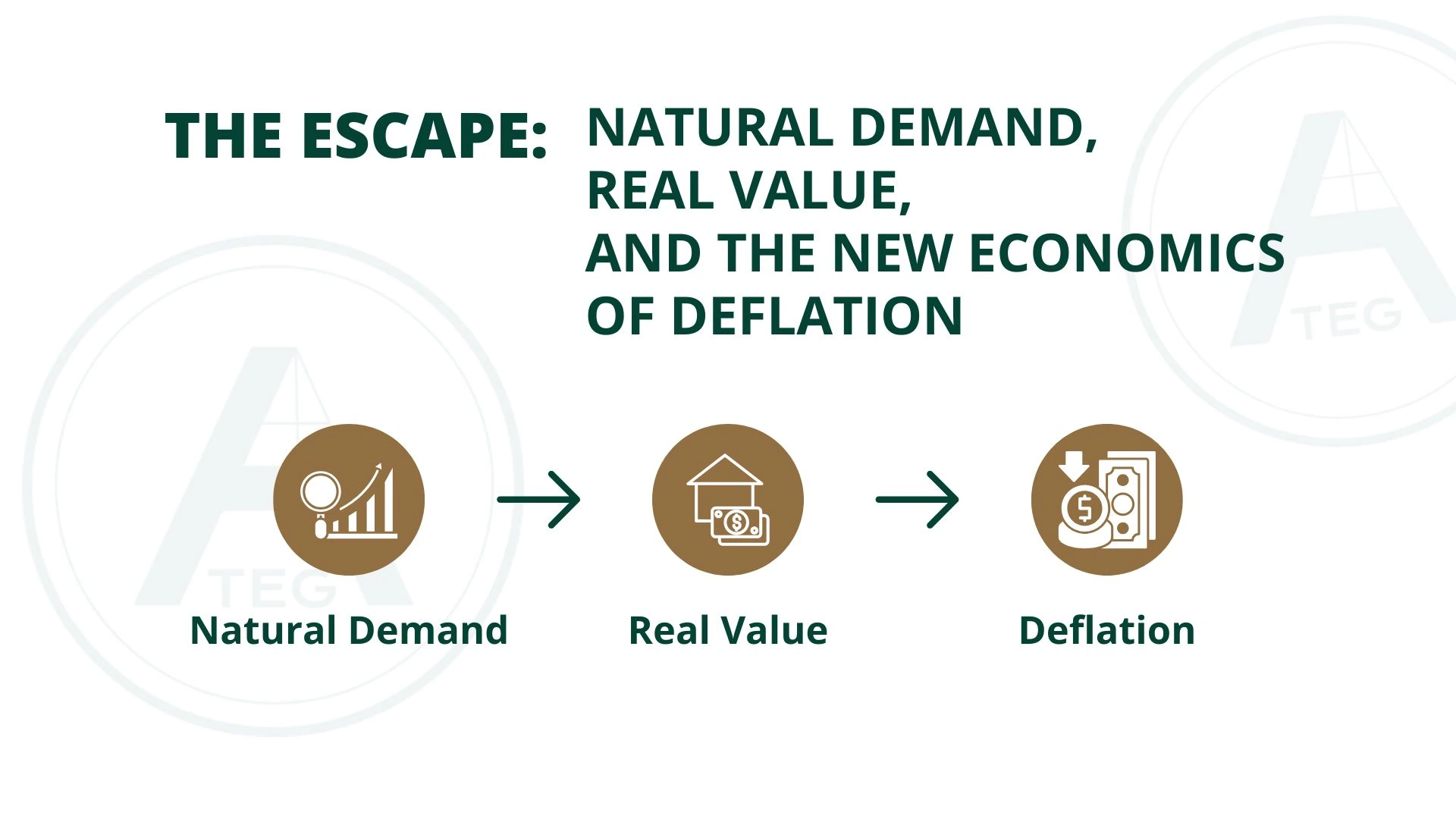

- Natural Demand Through Real Economic Flows

Demand emerges from real revenues — not speculation.

- Monthly Deflation Cycle

A structured and transparent mechanism where supply reduces in alignment with monthly value behavior.

- Real-World Anchoring (Balance Sheet = Revenue Tokenization)

In this model, Balance Sheet Tokenization and Revenue Tokenization are two perspectives on the same mechanism.

Revenues enter the ecosystem as real economic inputs, forming a predictable and measurable demand basis.

- Monthly Rhythm Integrated Into the Token

The system stabilizes according to the same time cycle families, households, and businesses use in their financial planning.

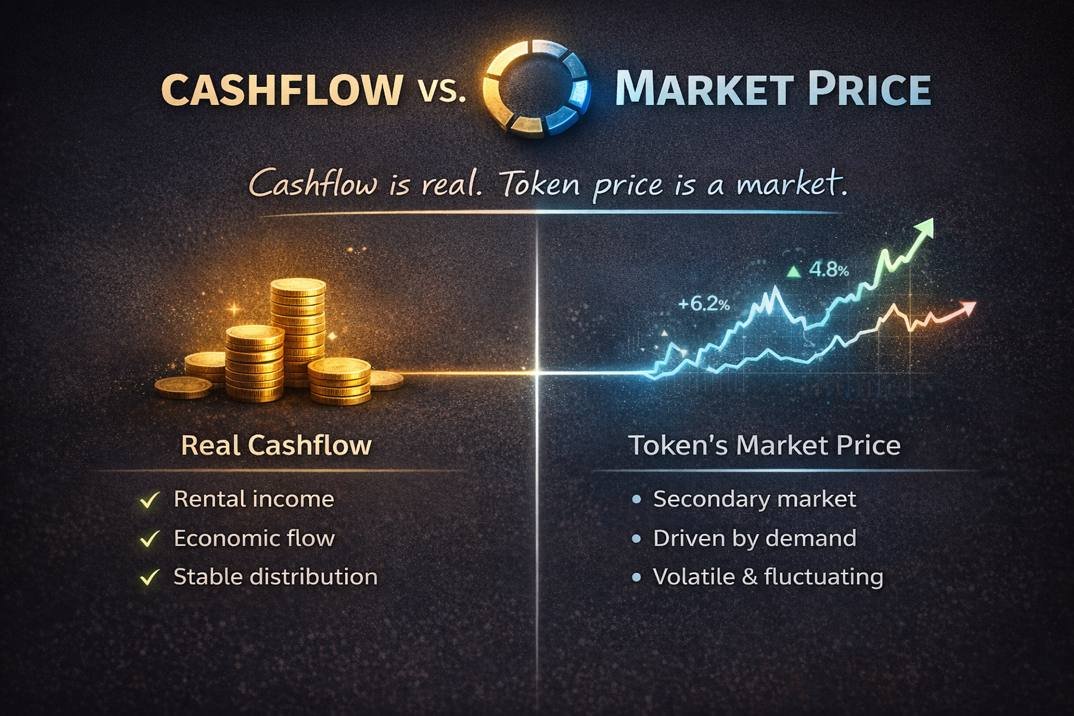

9️⃣ Free Market Participation — Inside the Monthly Cycle

Unlike stablecoins, the Hybrid Stability model preserves full market freedom:

- users can trade at any time

- volatility remains available for profit and strategy

- natural price discovery continues

- short-term movements remain unrestricted

- market participants retain full flexibility

The system does not eliminate volatility.

It positions it within a monthly cycle.

During the month:

Full trading freedom, full volatility, full opportunity.

At month’s end:

The Monthly Index acts as a stabilizing reference — not a price lock, not a peg, not a control mechanism.

🔟 The Monthly Index: The Golden Middle of Economic Behavior

The Monthly Real Value Index represents the golden middle:

- it filters noise

- reduces the impact of short-term extremes

- captures the true market trend

- reflects the natural equilibrium

Just as in mathematics, physics, biology, and economics, balance forms at the center — not at the extremes.

The golden middle is the point of maximum stability.

The Hybrid Stability model captures this principle explicitly.

1️⃣1️⃣ Why Monthly Stability Connects Crypto to Real Life

A monthly-aligned token model:

- aligns with human behavior

- enables predictable planning

- integrates naturally into rent, living, and energy cycles

- stabilizes long-term valuation logic

- maintains opportunity while reducing noise

- bridges digital and real economies

It transforms digital assets from speculative instruments into usable economic tools.

🧩 **Conclusion:

A Digital Economy Only Becomes Useful When It Reflects the Human Economy**

The next phase of digital assets will not be defined by faster settlement or lower fees.

It will be defined by alignment — alignment with the monthly cycles that govern real financial life.

Hybrid Stability introduces this missing layer.

It preserves opportunity, enables planning, respects market freedom, and stabilizes value around the golden middle of economic behavior.

It is not a faster system.

It is a more human system.