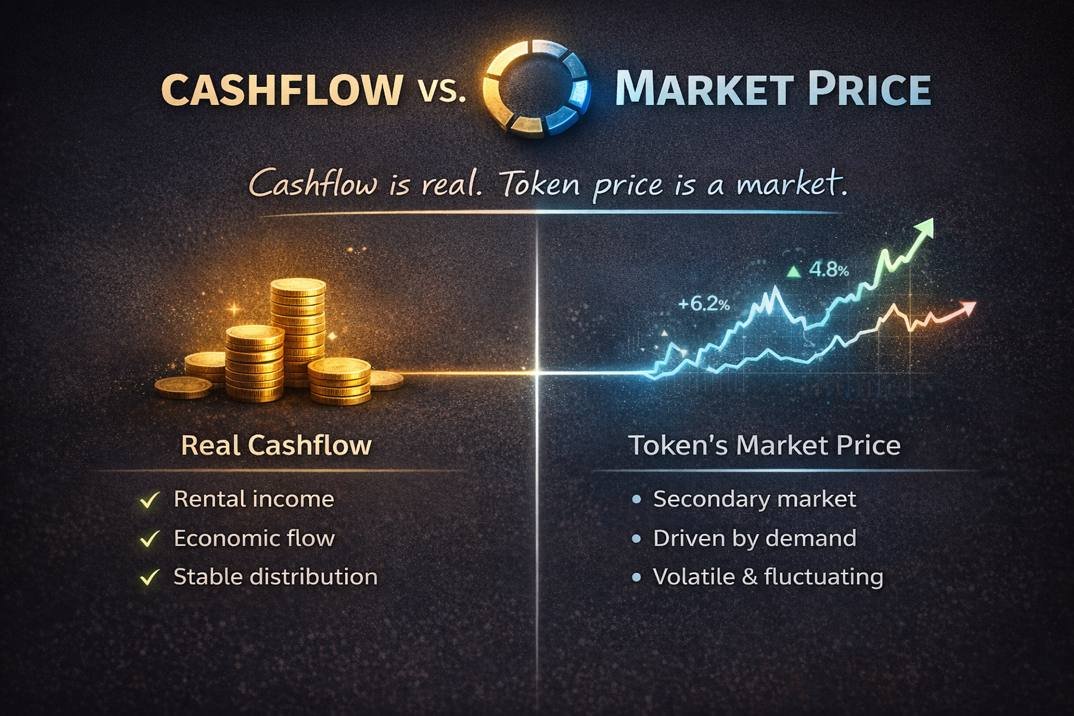

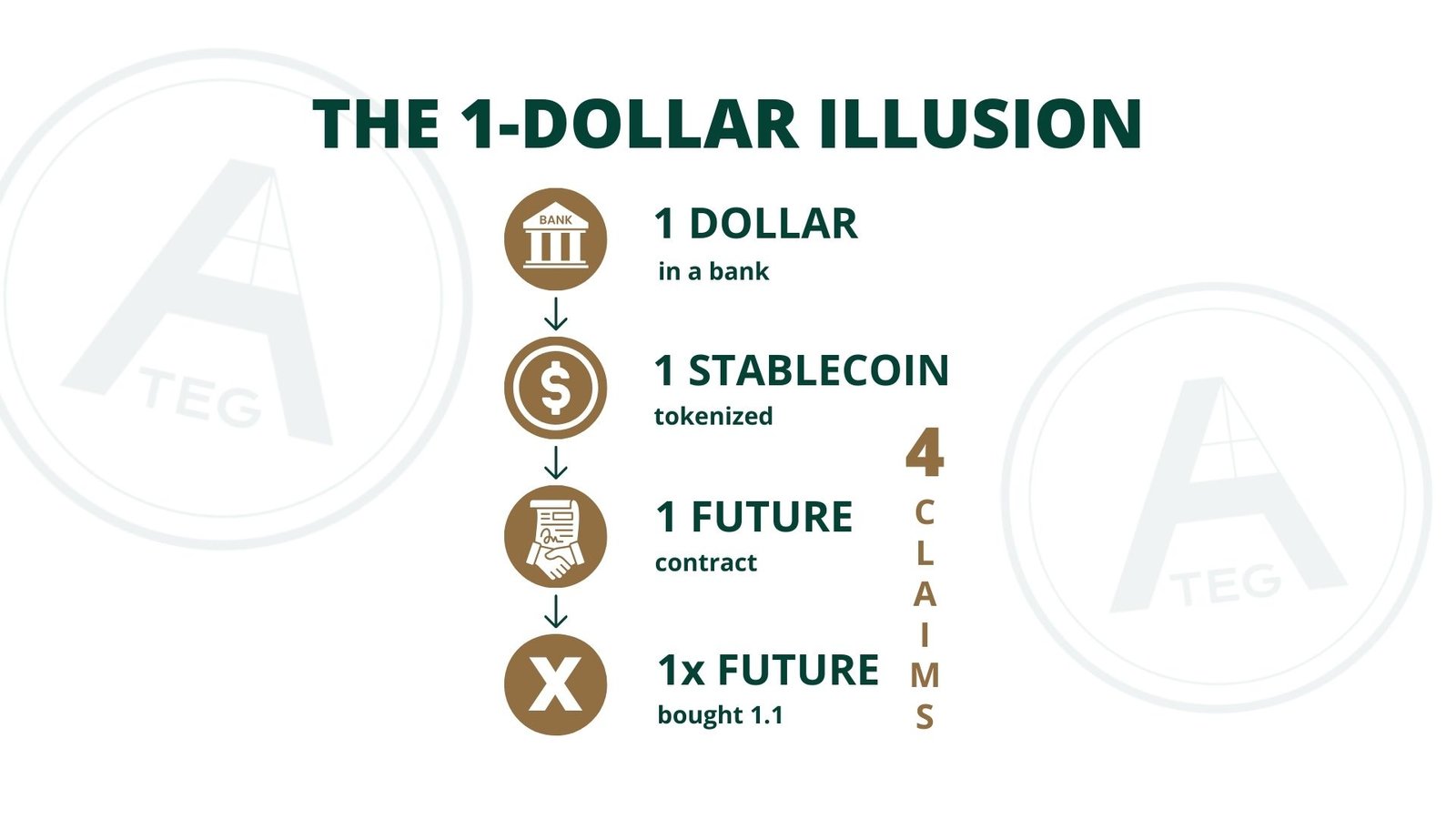

In income-distribution-focused tokenization models, this logic often becomes even more pronounced.

Tokenholders expect:

- stable distributions

- growing yields

- attractive returns over time

As a result, the system is implicitly optimized for higher rental income per unit.

This does not mean such models are malicious.

It means they are structurally aligned with rent maximization.

The economic pressure is clear:

- higher distributions require higher net income

- higher net income is most directly achieved through higher rents

Over time, this creates a tension between:

- investor return expectations

- and housing affordability

A structural dilemma, not a moral one

It is important to understand that this is not a question of intent.

Most traditional real estate and fractional ownership models simply follow the logic they are built on:

- income drives value

- value expectations drive pricing decisions

But this logic has a limit.

Housing is not a purely financial product.

It is a basic human need.

When value creation relies primarily on increasing rents, affordability inevitably comes under pressure.

Our design choice: decoupling value logic from rent pressure

At ATEG, we deliberately questioned this assumption.

We asked:

Does value creation have to depend on continuously rising rents?

Our answer was no.

Instead of optimizing the system around rent increases, we designed a structure that allows value dynamics to emerge from economic efficiency and structural mechanisms, not from higher housing costs.

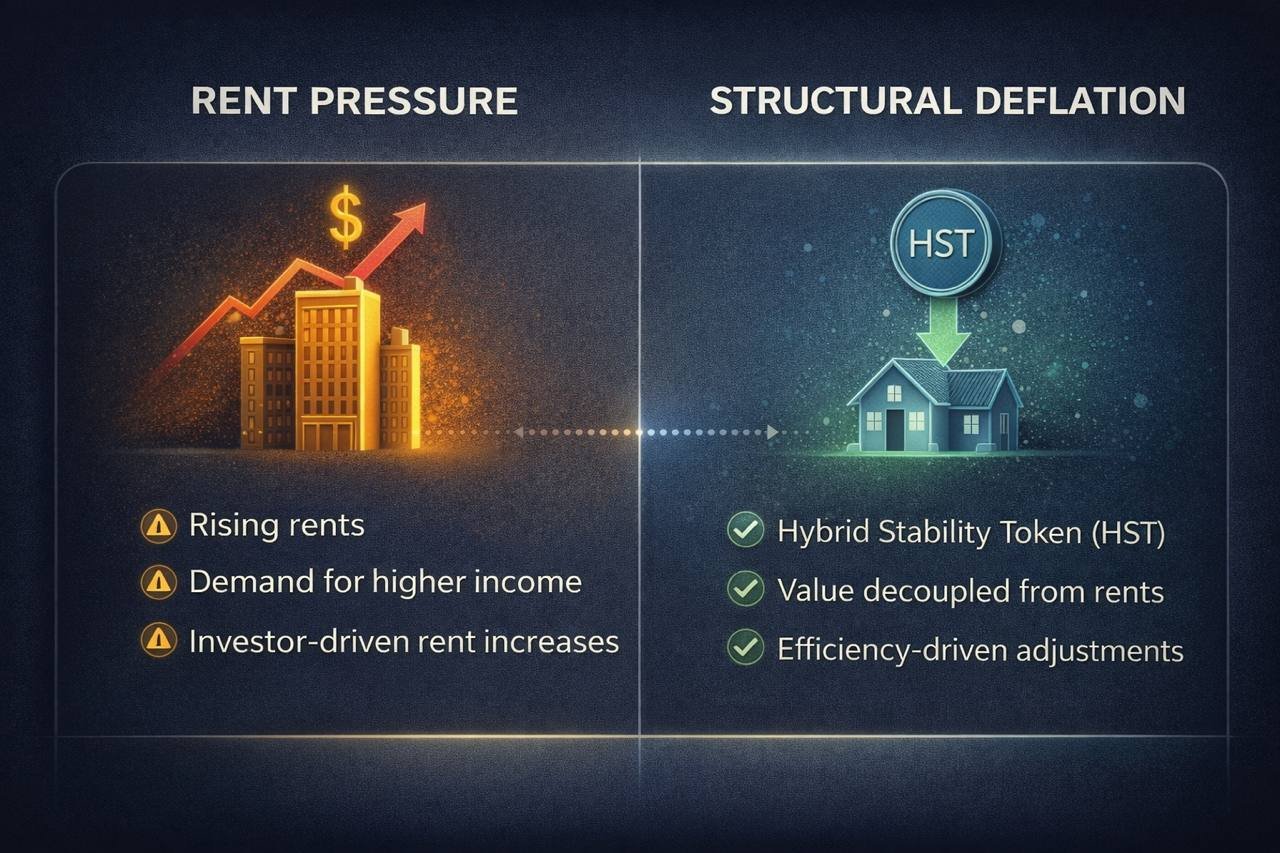

The role of the Monthly Index and the Hybrid Stability Token (HST)

The Hybrid Stability Token (HST) and the Monthly Index introduce a fundamentally different logic.

Rather than tying value directly to rent increases, the model focuses on:

- predictable, index-based economic cycles

- operational performance and efficiency

- structural supply-side mechanisms

The Monthly Index acts as a stabilizing reference point that:

- aligns token dynamics with real monthly economic activity

- reduces dependence on speculative price movements

- allows value adjustments without forcing rent escalation

In parallel, the deflationary structure operates on the supply side of the token, not on the cost side of housing.

This distinction is critical.

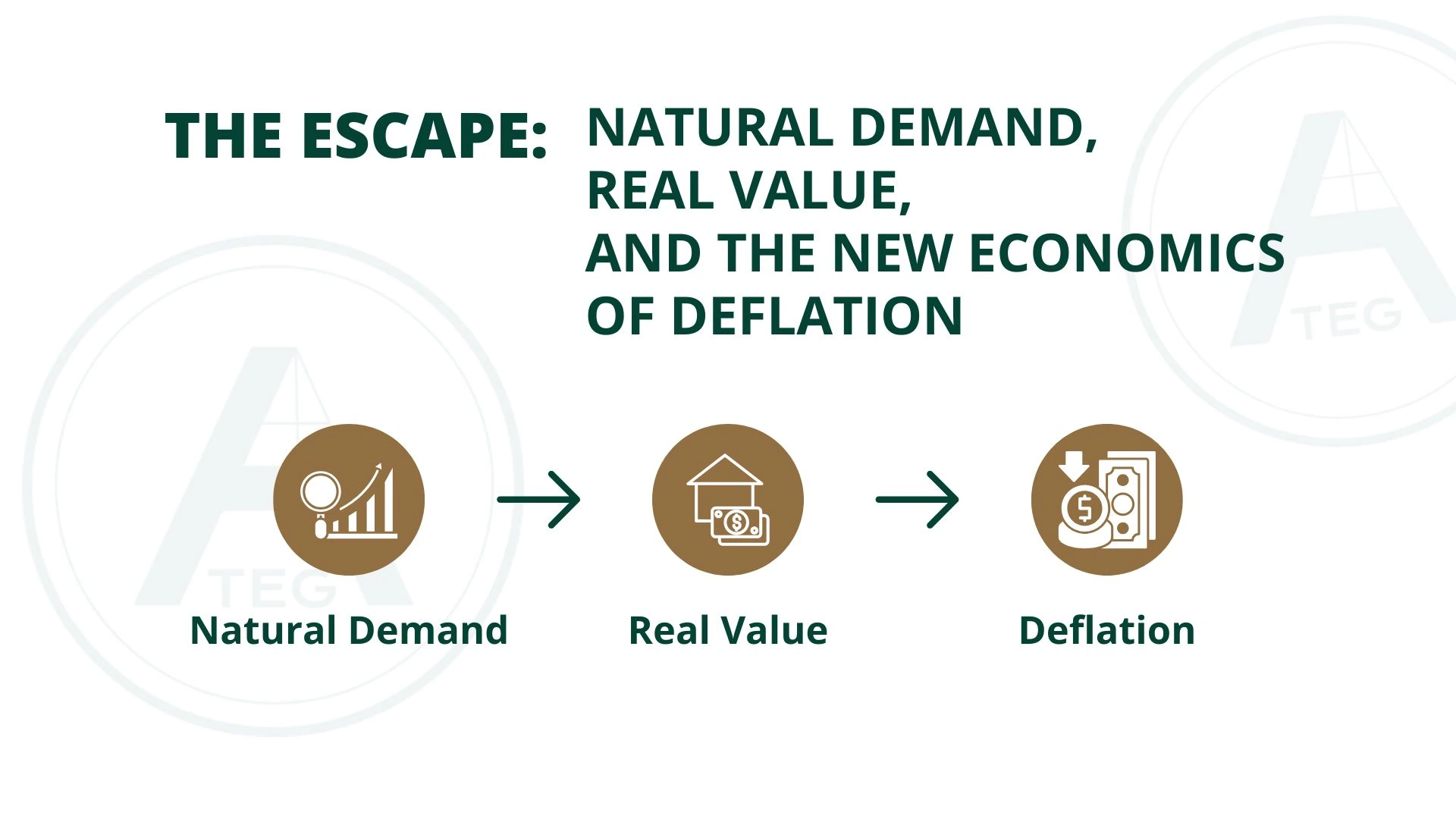

Deflation through structure, not through higher living costs

In many systems, higher returns are achieved by pushing costs outward — often toward tenants.

In our model, deflationary effects are created through:

- predefined structural mechanisms

- economic activity and performance

- supply-side adjustments of the token system

This allows value dynamics to exist without requiring tenants to pay more each month.

In simple terms:

Value does not need to be extracted from higher rents.

It can be created through structure.

A different alignment of incentives

This approach leads to a different incentive structure:

- residents are not treated as the primary source of value extraction

- investors are aligned with long-term system stability, not short-term rent increases

- affordability and value creation are no longer opposing forces

By separating housing costs from speculative value dynamics, the system gains flexibility.

Lower pressure on rents does not weaken the model —

it strengthens its sustainability.

Why this matters beyond finance

Housing affordability is not just an economic issue.

It is a social one.

A system that can grow without systematically increasing living costs has broader relevance:

- for cities

- for families

- for long-term community stability

Our intention is not to claim perfection.

It is to demonstrate that alternative structures are possible.

🧩 Closing thought

If value can only be created by charging people more for living, the system will eventually break.

If value can be created through structure, efficiency, and alignment,

housing can remain what it should be:

A place to live — not a pressure point for returns.