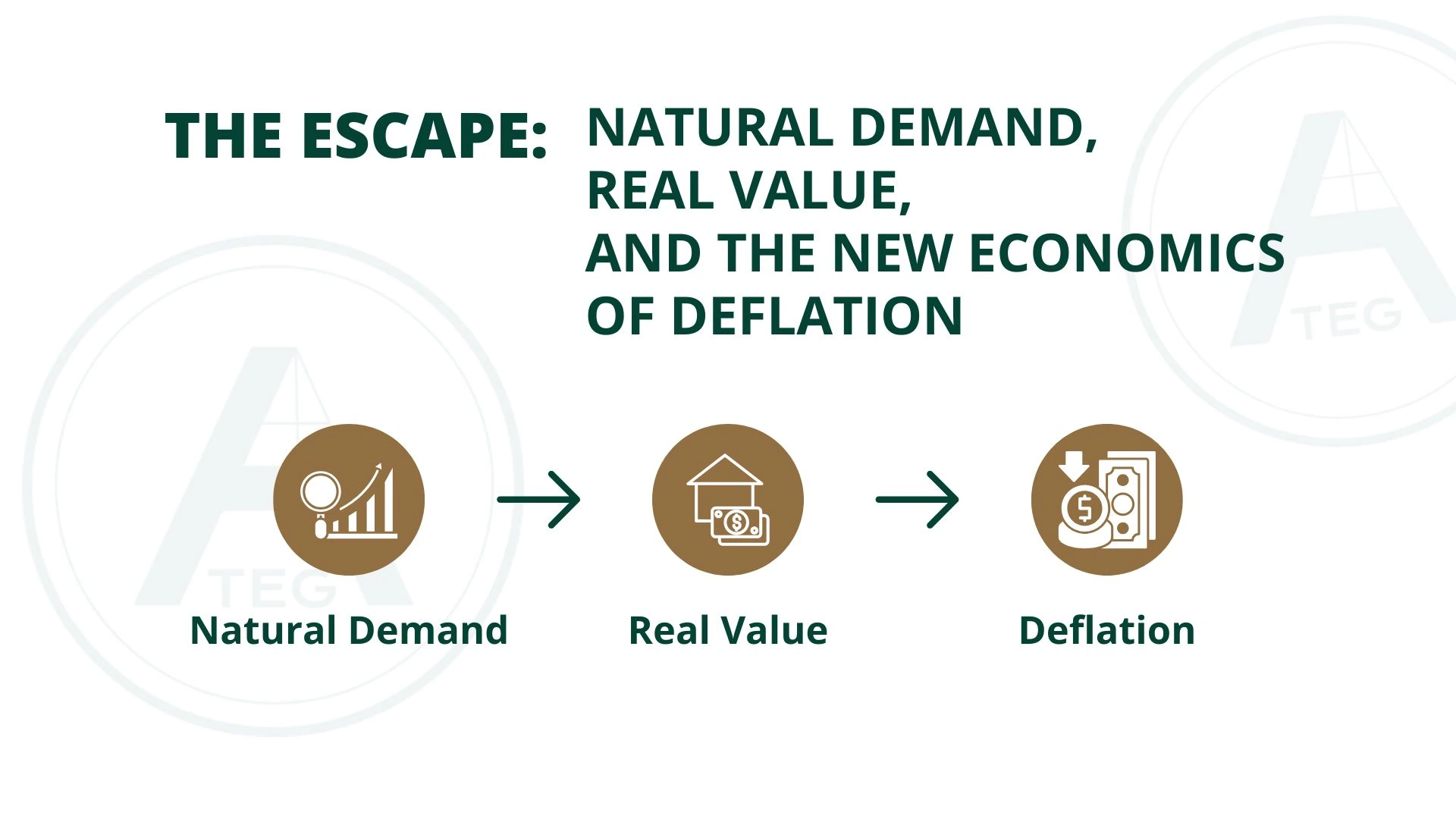

1️⃣ Natural Demand: The Foundation of Sustainable Systems

Natural demand is the most important characteristic of any durable economic model. It arises not from incentives or promotions, but from necessity — when participants engage with an ecosystem because it provides real utility, measurable benefits, or access to value that cannot be replicated elsewhere.

Natural demand is created when:

- participants require access to a service

- value is tied to real economic activity

- usage continues independent of market sentiment

- the system offers clear functional purpose

- demand grows as the underlying economy grows

Unlike artificial demand, natural demand does not depend on constant external stimulation. It forms automatically when a system generates real outcomes that people want or need.

In traditional markets, natural demand underpins consumption, housing, energy, infrastructure, and every recurring economic cycle. In digital markets, natural demand remains rare — but it is essential for long-term viability.

2️⃣ Real Value: Anchoring the Digital Layer to the Economic Layer

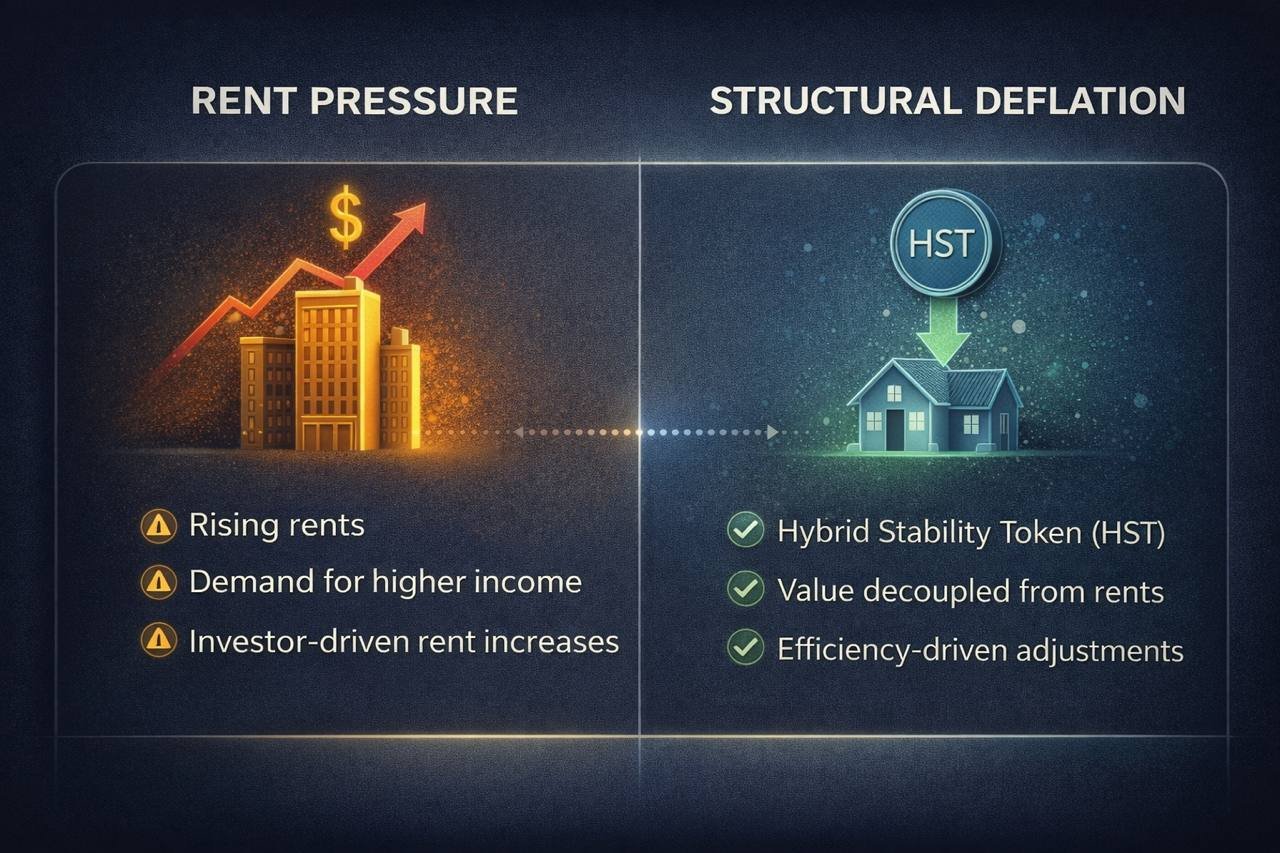

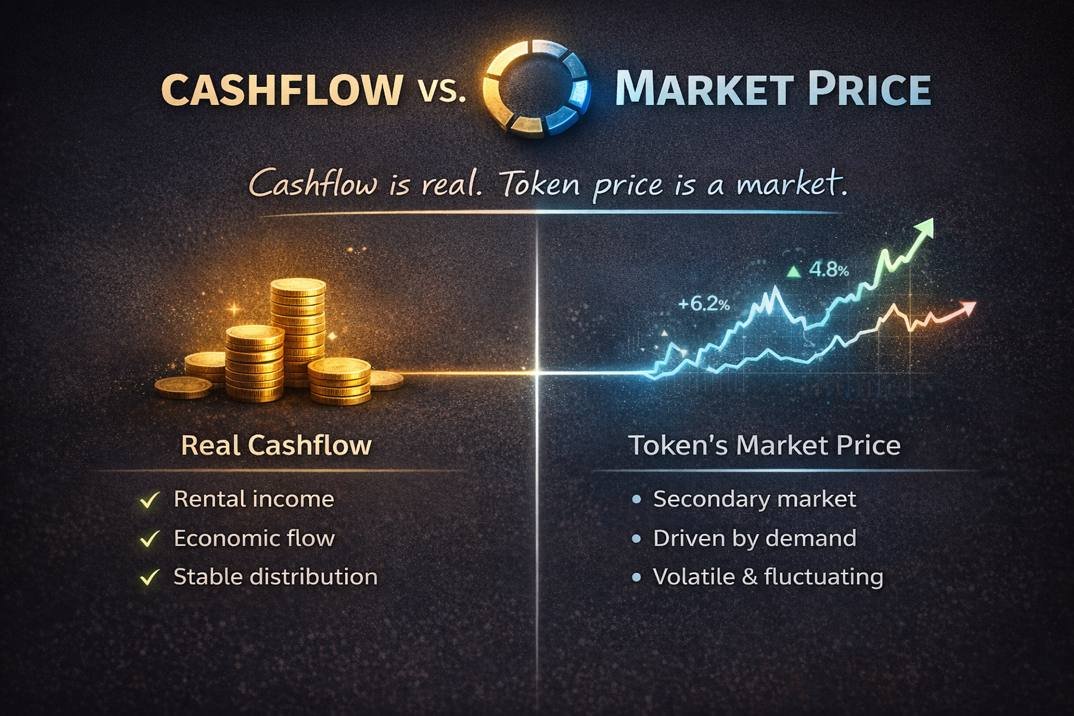

Real value emerges when a digital asset is linked to tangible or recurring economic activity rather than speculative motion. This connection creates a stabilizing anchor that separates systems with substance from systems driven solely by market psychology.

Real value may come from:

- recurring revenues

- production of goods or services

- energy generation

- tenancy or rental activity

- operational cashflows

- measurable economic outputs

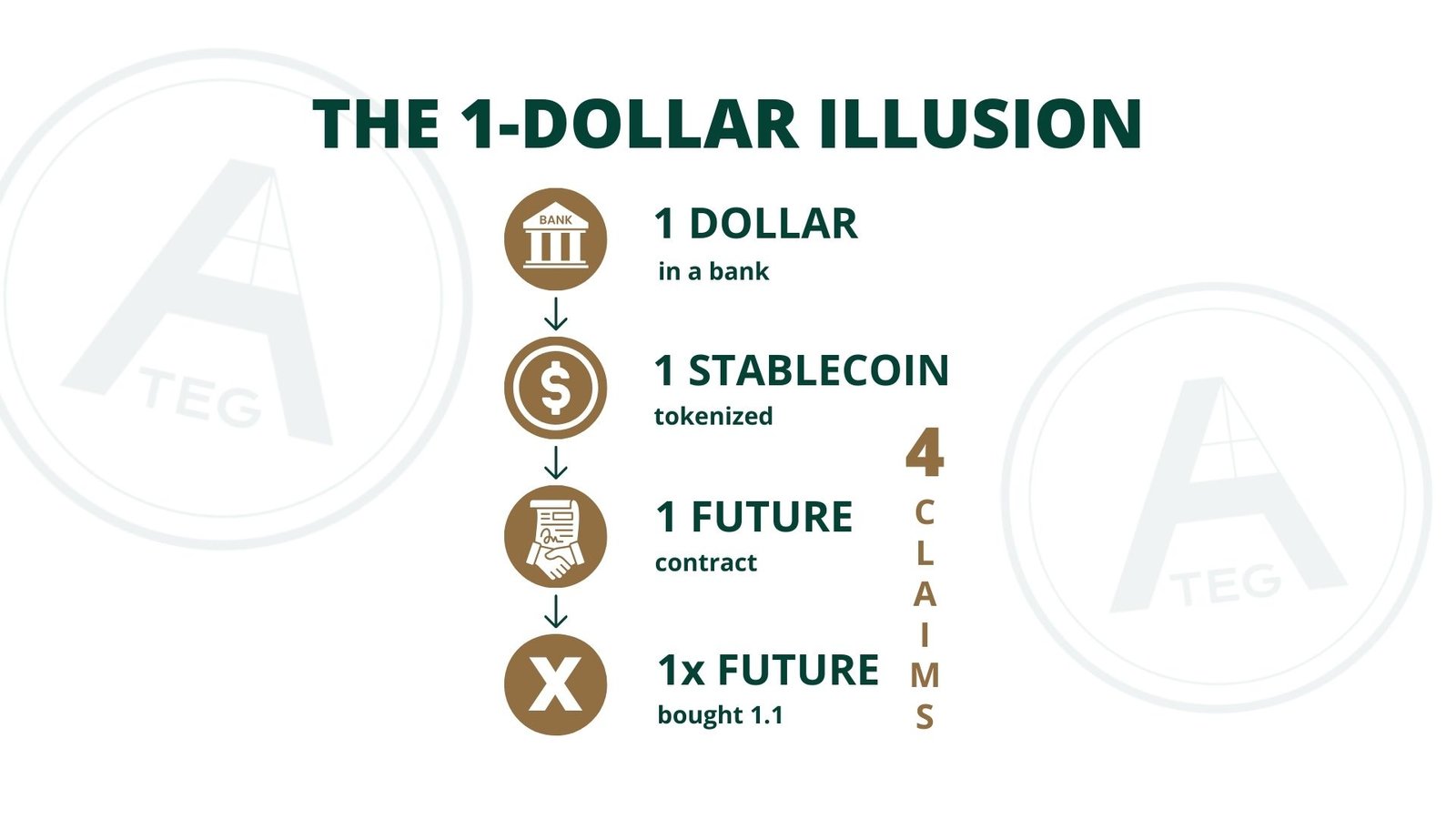

When digital assets reflect real value, they become more than financial abstractions. They evolve into instruments that track, represent, or interact with genuine economic fundamentals.

This bridge between the digital layer and the real economy protects ecosystems from volatility, sentiment-driven cycles, and internal fragility.

3️⃣ Deflation: A Strengthening Mechanism, Not a Downward Pressure

Deflation is typically misunderstood as a negative concept associated with falling prices. But in digital-economic systems built on fixed supply or controlled supply mechanisms, deflation functions very differently.

Deflation, when designed correctly, does not reduce economic activity.

It reinforces value by:

- reducing circulating supply over time

- increasing the economic density of each unit

- aligning unit value with the growth of real activity

- preventing overexpansion of synthetic claims

- strengthening stability as participation increases

In a system backed by natural demand and real value, deflation becomes a stabilizing force. Each unit becomes more valuable not through speculation, but because the underlying economics support a higher value per unit as supply decreases and economic output increases.

This is not speculative deflation.

It is structural deflation — rooted in economics, not market emotions.

4️⃣ When These Three Forces Combine

A system built on natural demand, real economic value, and responsible deflation creates a fundamentally different environment from typical speculative ecosystems.

Such a system:

- does not rely on continuous promotion

- does not depend on short-term sentiment

- does not require speculative cycles to maintain value

- remains stable even when the market is unstable

- grows as real economic activity grows

- strengthens as supply contracts

- aligns long-term value with long-term performance

This represents a shift from activity-driven growth to economy-driven growth — a far more stable and predictable model.

5️⃣ The New Economics of Digital Deflation

The next evolution of digital ecosystems will likely center on controlled, economically supported deflation paired with measurable real-world productivity. In this model, deflation is not a pressure downward, but a mechanism upward — concentrating economic value, distributing strength across the ecosystem, and anchoring digital units in real activity.

This “new economics of deflation” transforms token dynamics from speculative to structural:

- value follows real output

- supply aligns with economic logic

- demand emerges naturally

- stability increases with growth

- ecosystems mature into long-term economic systems

This is the foundation for sustainable digital markets and a future where the digital and real economies operate in harmony rather than isolation.

🧩 Conclusion

The path forward for digital-asset ecosystems is not more marketing, more hype, or more short-term activity. It is a shift toward natural demand, real economic value, and intelligent deflation mechanisms that strengthen systems as they grow.

These elements form the basis of a more stable, mature, and economically grounded digital economy — one that can thrive beyond sentiment cycles and contribute meaningfully to long-term value creation.