1️⃣ The Cycle Begins: Attention as a Substitute for Adoption

Many projects enter the market with a strong narrative, a compelling identity, or a series of high-energy announcements. In the early stages, this often generates excitement, online discussions, community growth, and price movement.

However, attention alone does not constitute adoption.

The difference is subtle, but foundational:

- Attention is temporary.

- Adoption is structural.

When attention is mistaken for adoption, projects enter a loop where the primary objective becomes maintaining visibility rather than building functionality.

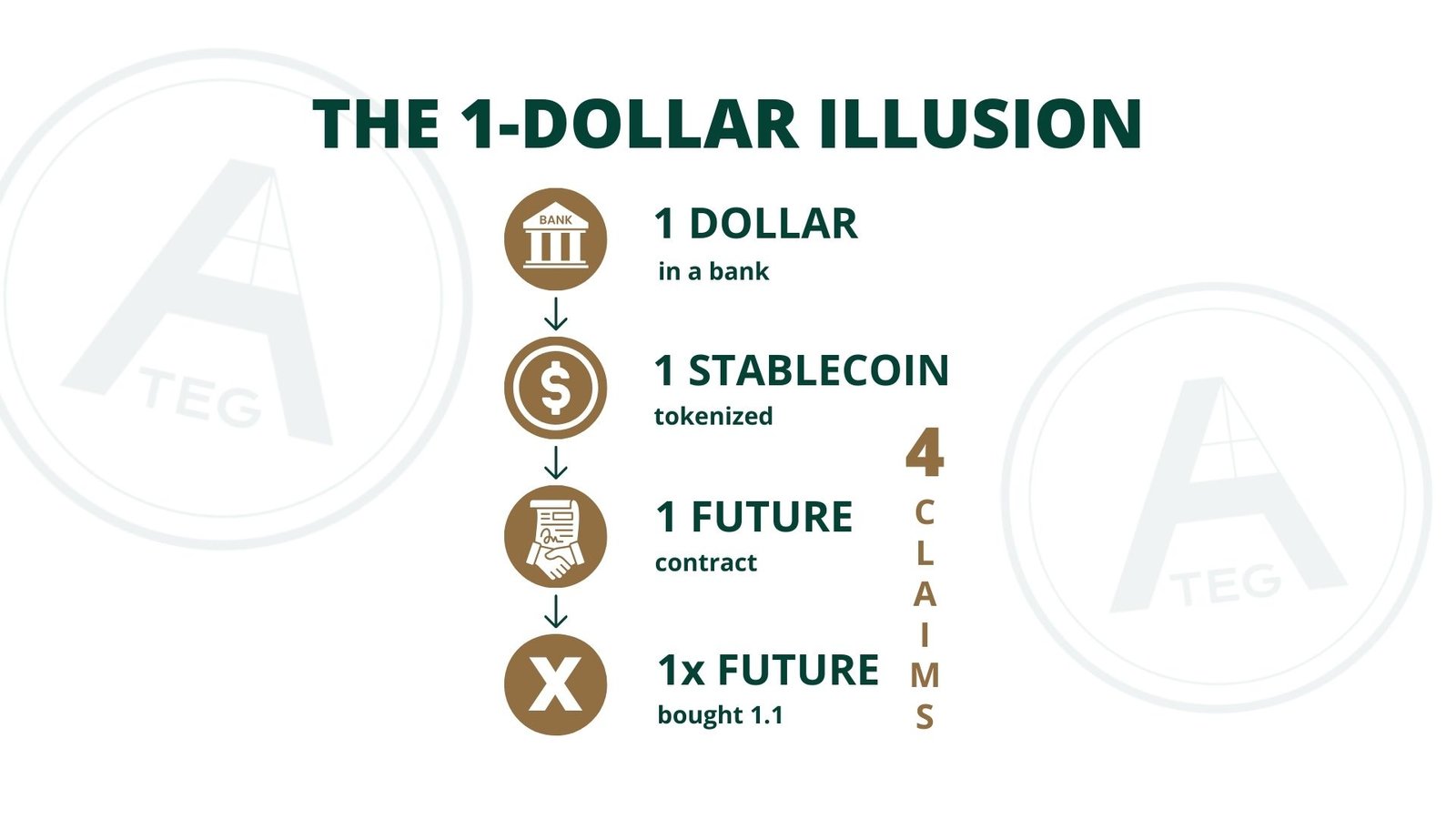

2️⃣ Artificial Demand: When Marketing Takes the Place of Value

Artificial demand refers to any form of activity designed to simulate economic traction without an underlying source of real utility or productivity. This can include various forms of promotion, trending challenges, short-term incentives, aggressive advertising, or highly speculative listing events.

While none of these activities are inherently negative, they create a dependency:

- When activity slows, the demand disappears.

- When incentives stop, participation declines.

- When excitement fades, the price collapses.

The ecosystem becomes reactive, not resilient.

Artificial demand produces motion, but not progress.

3️⃣ The Emotional Loop: Volatility as a System, Not a Side Effect

Because many digital-asset markets rely on sentiment rather than fundamentals, price becomes the central driver of engagement. A rising price attracts more attention; falling prices reduce activity.

This creates an emotional cycle:

- Excitement

- Rapid growth

- Overextension

- Loss of confidence

- Withdrawal of activity

- Restart with a new narrative

This loop repeats across thousands of projects.

From the inside, this can feel like continuous participation.

From the outside, it becomes clear that the system is cycling in place.

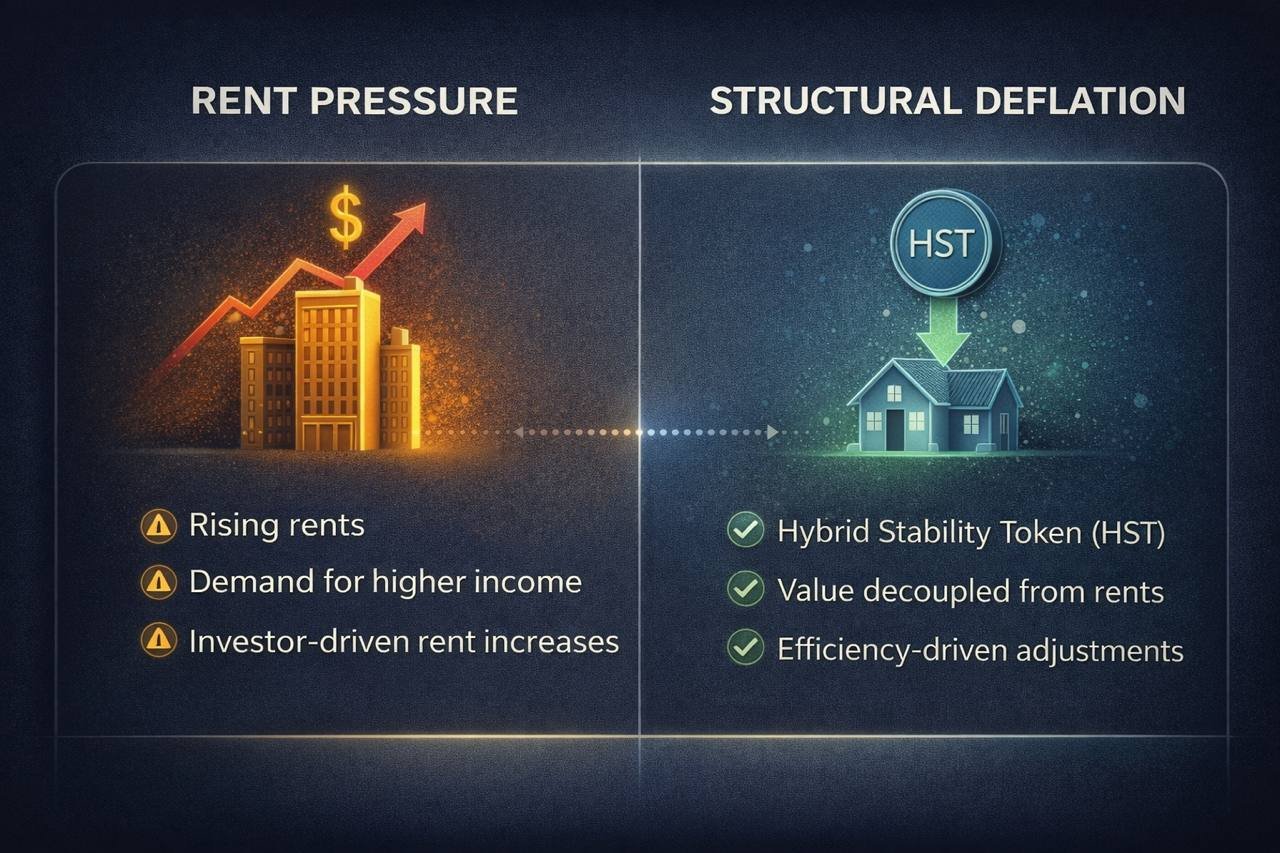

4️⃣ The Missing Component: Natural Demand

For any sustainable financial or digital ecosystem, long-term demand must originate from a real source — not from marketing, not from incentives, not from speculation, and not from community sentiment alone.

Natural demand arises when an asset is required to capture or represent something with measurable economic value. This includes:

- real consumption

- real revenues

- recurring economic activity

- tangible use cases

- real participants whose motivation is not speculative

Without natural demand, ecosystems depend entirely on external energy.

With natural demand, ecosystems can sustain themselves.

This distinction determines whether a system cycles or progresses.

5️⃣ Why the Hamster Wheel Continues

The cycle persists for several reasons:

- It is familiar. Many participants have only experienced markets shaped by short-term narratives.

- It is simple. Artificial demand is easier to create than real utility.

- It is emotional. Human behavior reinforces momentum.

- It is visible. Market attention gravitates to volatility, not stability.

- It is fast. Artificial demand can create rapid early traction.

However, these advantages come with structural limitations: once the cycle slows, it must restart from the beginning.

The wheel only moves when someone keeps pushing it.

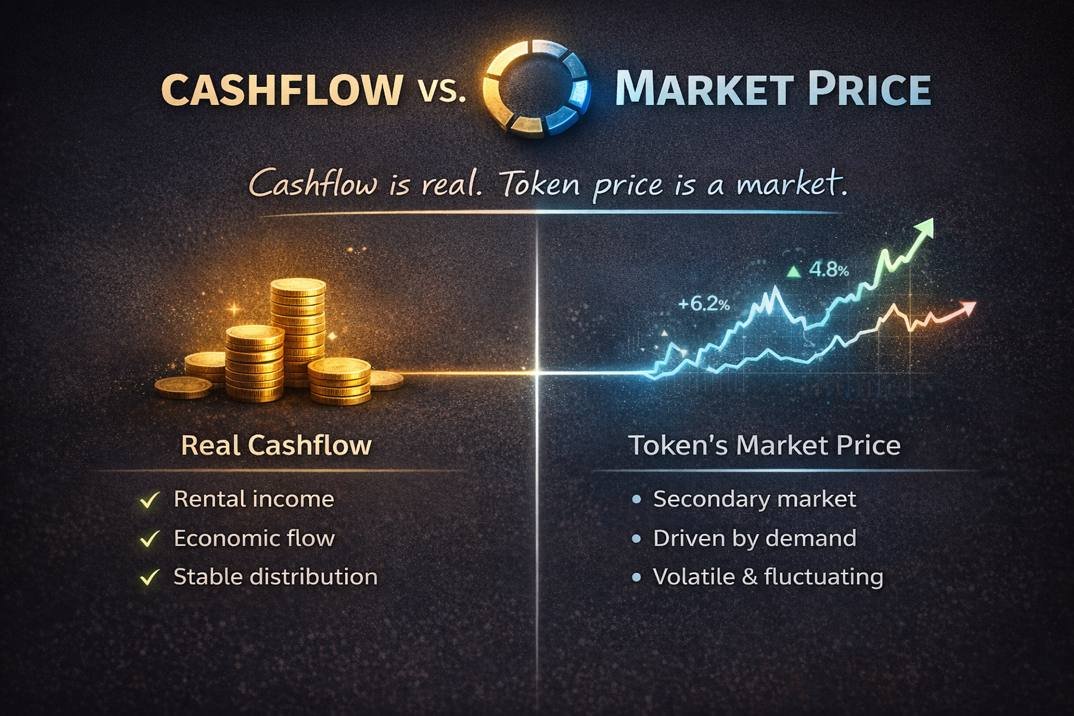

6️⃣ Breaking the Cycle Requires a Shift in Foundation

For digital assets to evolve beyond sentiment-driven momentum, the foundation must shift from:

- short-term activity → to long-term value

- speculative participation → to economic participation

- external incentives → to internal necessity

- emotional cycles → to structural demand

This transition mirrors the evolution of traditional markets, where systems eventually stabilize around real economic inputs: production, consumption, services, and revenues.

The digital-asset sector is now approaching the same inflection point.

7️⃣ Moving Forward: A More Sustainable Digital Economy

Recognizing the difference between motion and progress is essential for the next phase of Web3 maturity. The most durable digital ecosystems will be those that:

- generate measurable value

- produce recurring economic flows

- remain stable through sentiment cycles

- attract participation for reasons beyond speculation

- anchor their systems in real demand rather than artificial momentum

This shift requires transparency, discipline, and a clear understanding of how sustainable financial systems are built.

🧩 Conclusion

The “crypto hamster wheel” is not a criticism of the industry — it is an observation of a pattern.

A cycle formed not by technology, but by incentives, expectations, and behaviors. The path forward lies not in running faster, but in stepping off the wheel entirely and building foundations where demand arises naturally, where value precedes price, and where growth reflects genuine economic substance.

This understanding is essential for any ecosystem seeking long-term relevance in an increasingly mature digital economy.