Understanding Value, Demand, and Reality

You bought a token.

You receive rental income.

But an important question often remains unanswered:

Why should the token itself become more valuable over time?

This article is not about criticism.

It is about understanding.

Our goal is simple:

to help people better understand how real estate tokenization works, where value really comes from, and why different models lead to very different outcomes.

Education creates clarity.

Clarity creates trust.

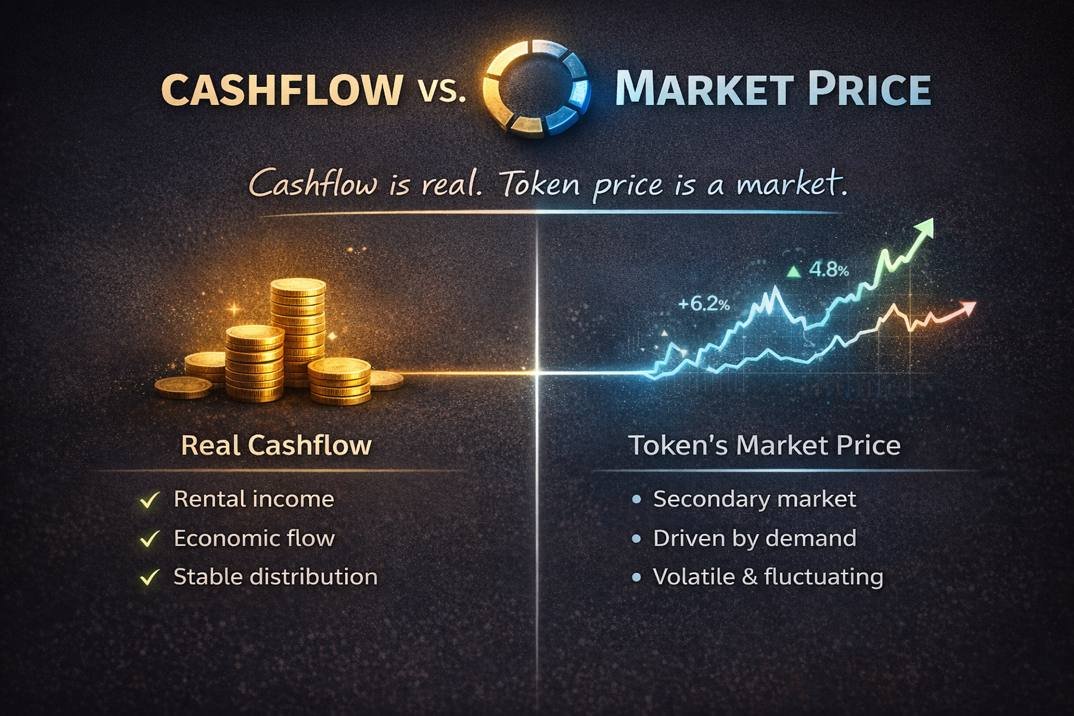

Cashflow and token price are not the same thing

Many real estate tokenization models are built around a familiar idea:

- A property generates rental income.

- That income is distributed to tokenholders.

- Therefore, the token should become more valuable.

At first glance, this seems logical.

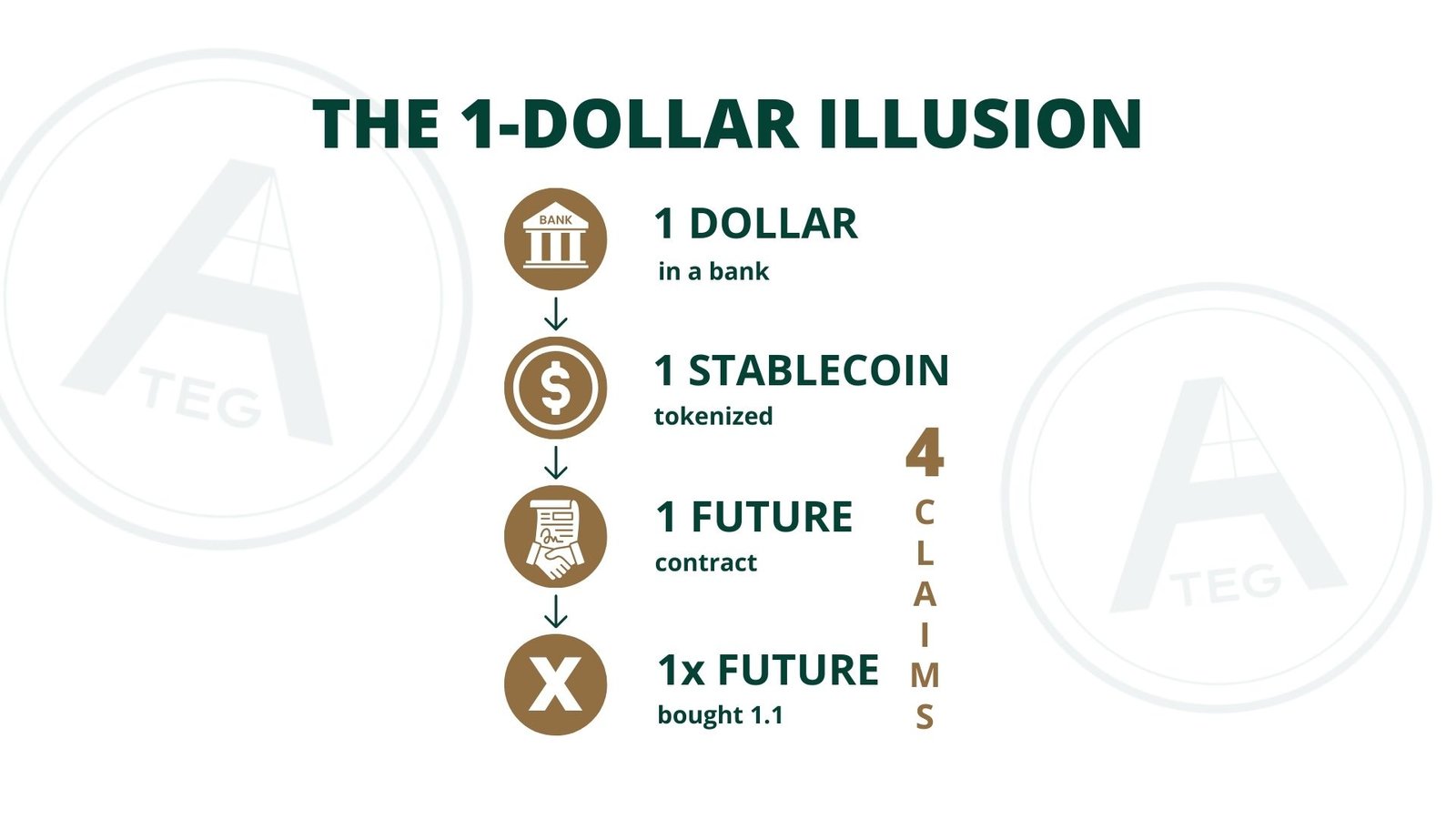

But in reality, cashflow and token price are two different layers.

Rental income is a real economic flow.

The token price, however, is formed on a secondary market.

And a secondary market follows one rule above all others:

Price is determined by supply and demand.

Not by intention.

Not by narrative.

Not automatically by income.

Where does demand for the token actually come from?

This is the key question that deserves honest attention.

In many fractional real estate models, tokens are initially sold to investors.

After that, the majority of tokens are held by those same investors.

On the secondary market:

- tokens are bought and sold mainly between existing holders

- price movements are often driven by liquidity and sentiment

- the underlying property may remain stable while the token price fluctuates

This creates a situation where trading activity itself can be mistaken for demand.

But trading alone is not the same as natural demand.

Natural demand usually comes from an external reason to own the token —

not simply from the hope that someone else will buy it later.

When can a token price rise in a meaningful way?

There are valid scenarios in which a token linked to real estate can increase in value.

For example:

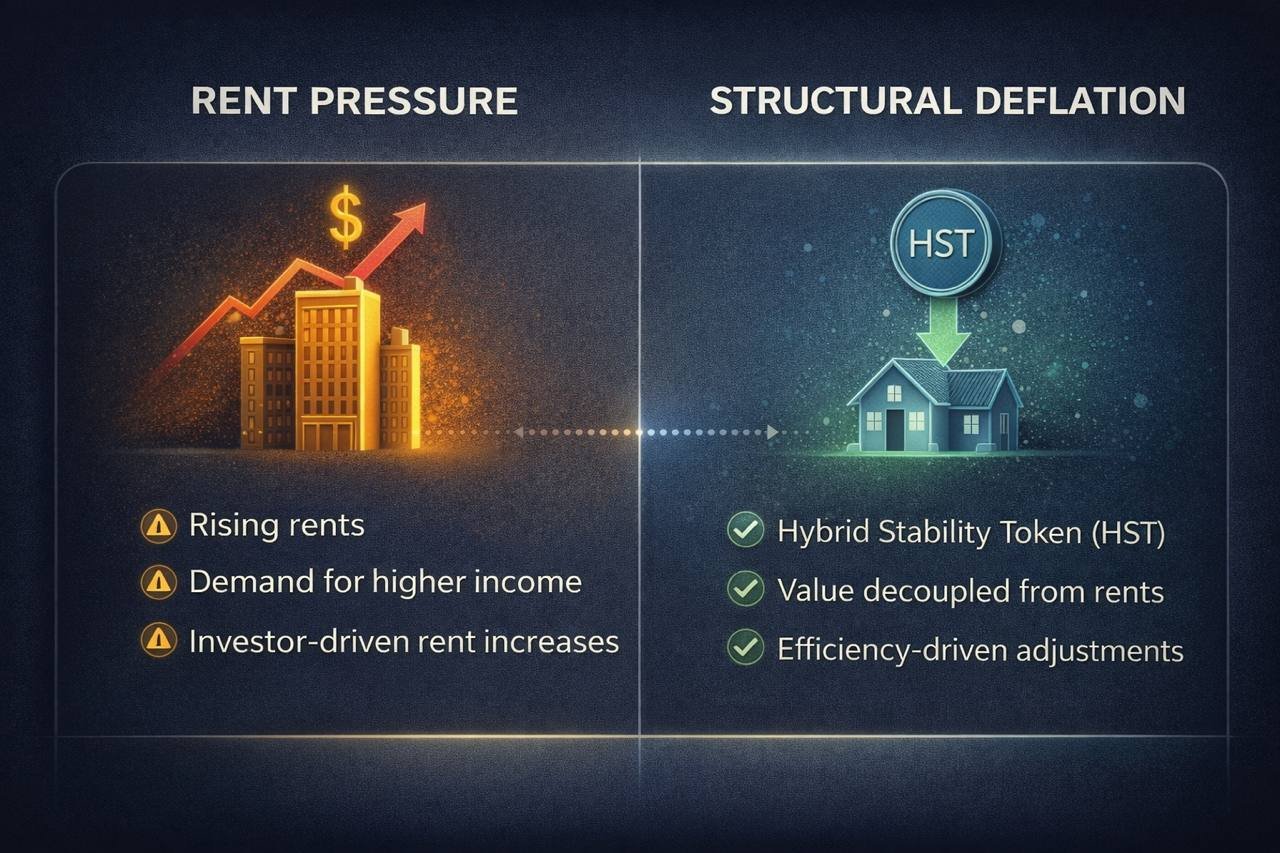

- the underlying property becomes more valuable

- rental income increases sustainably

- risk decreases due to better structure or transparency

In these cases, the economic value of the project improves.

However, this does not automatically translate into a higher token price unless:

- the market recognizes and prices in that improvement

- or there is a clear mechanism connecting real-world value to the token

Without such a connection, price movements can become detached from fundamentals.

The difference between participation and price dynamics

Many real estate tokens work well as participation instruments.

They can:

- distribute income

- provide exposure to real assets

- offer access to otherwise illiquid markets

But participation alone does not explain why a token should be increasingly demanded over time.

If a token’s only function is to hold it and receive distributions,

then its price may behave more like a yield instrument than a growth asset.

This is not inherently good or bad.

It simply needs to be understood clearly.

Why understanding this distinction matters?

Confusion often arises when three different things are mixed together:

- ownership

- income participation

- token price appreciation

Each follows different rules.

When people expect price growth without understanding the demand mechanism behind it, disappointment is almost inevitable.

Education helps avoid that.

Why we chose a different approach

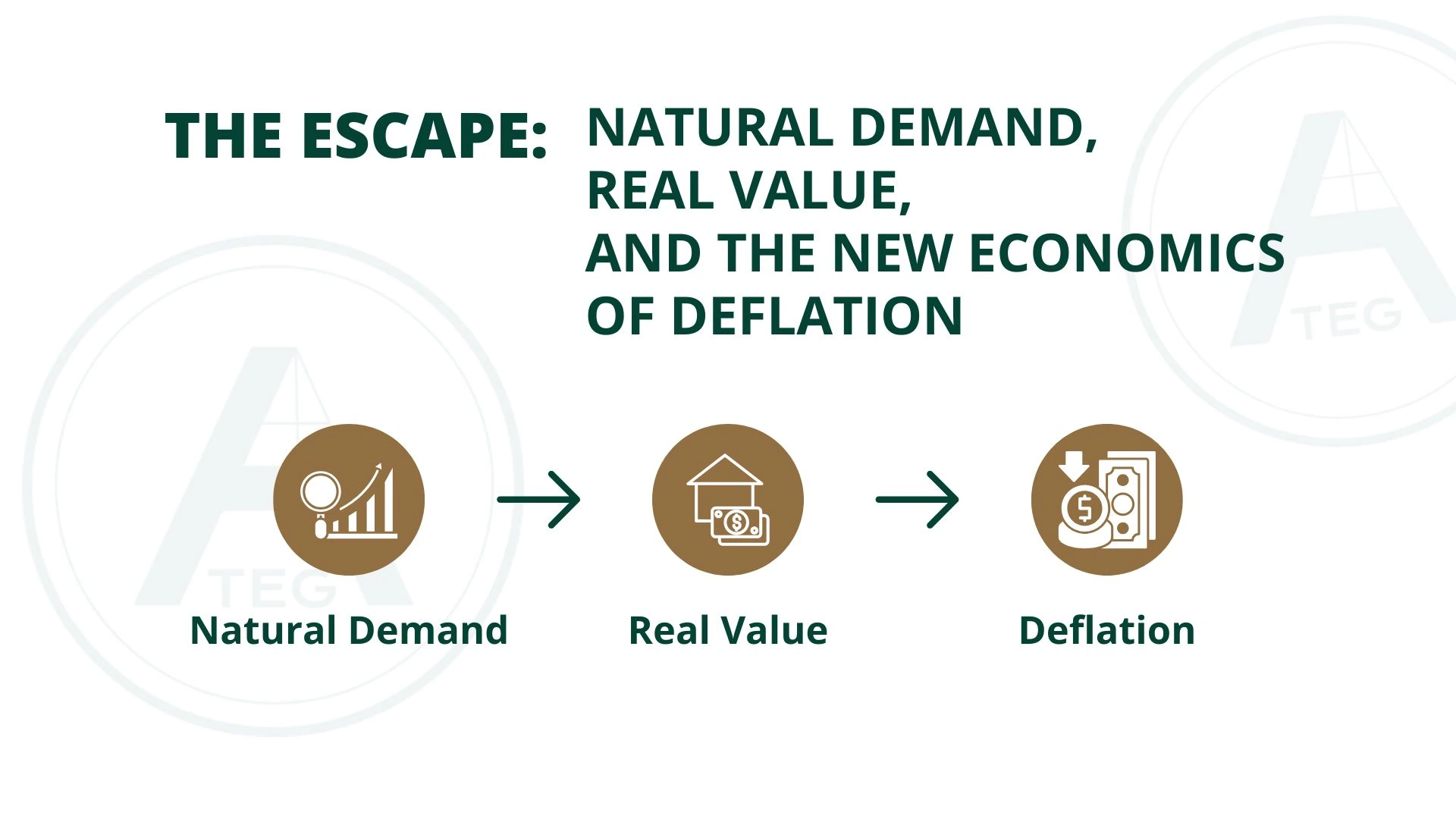

At ATEG, we started by asking a different question:

What creates continuous, structural demand — not just trading activity?

Instead of focusing only on distributing income, our model is designed to:

- align token dynamics with real economic processes

- connect value to ongoing activity, not just initial funding

- make price logic understandable, not speculative

Transparency was more important to us than simplicity.

We believe people deserve to understand why something may grow in value —

not just be told that it will.

Education before expectation

Real estate tokenization is a powerful concept.

But like any financial structure, it only works sustainably when expectations match reality.

Understanding the difference between:

- income and price

- participation and demand

- structure and speculation

is not a weakness.

It is the foundation of responsible innovation.

🧩 Final thought

Tokenization does not fail because of technology.

It fails when people are not given the full picture.

Our intention is not to convince —

but to explain.

Because informed participants build stronger systems than hopeful ones.