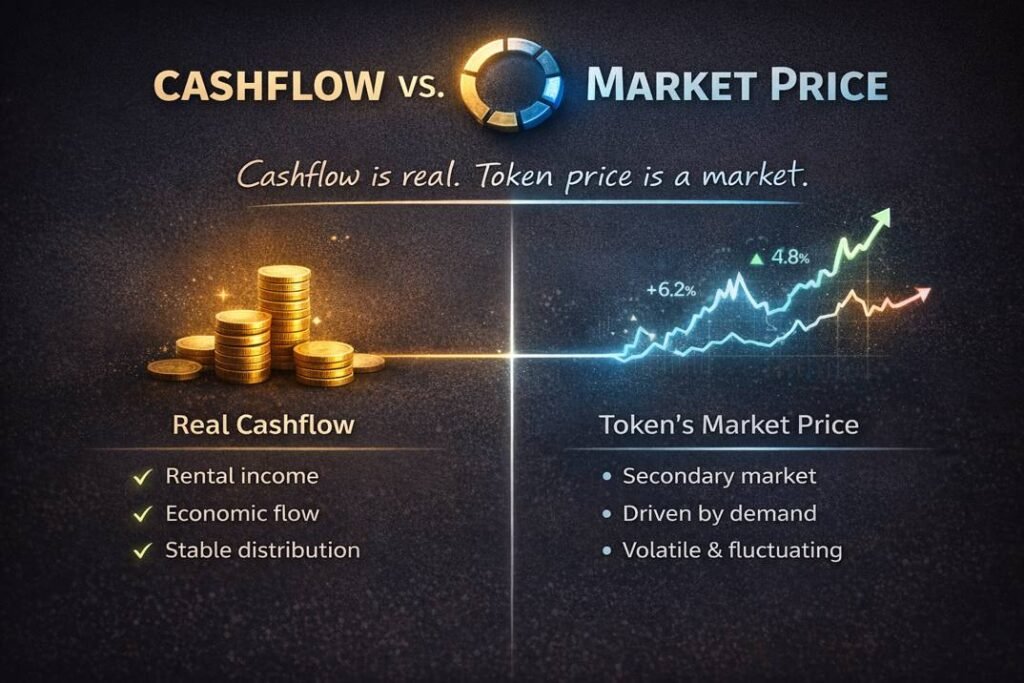

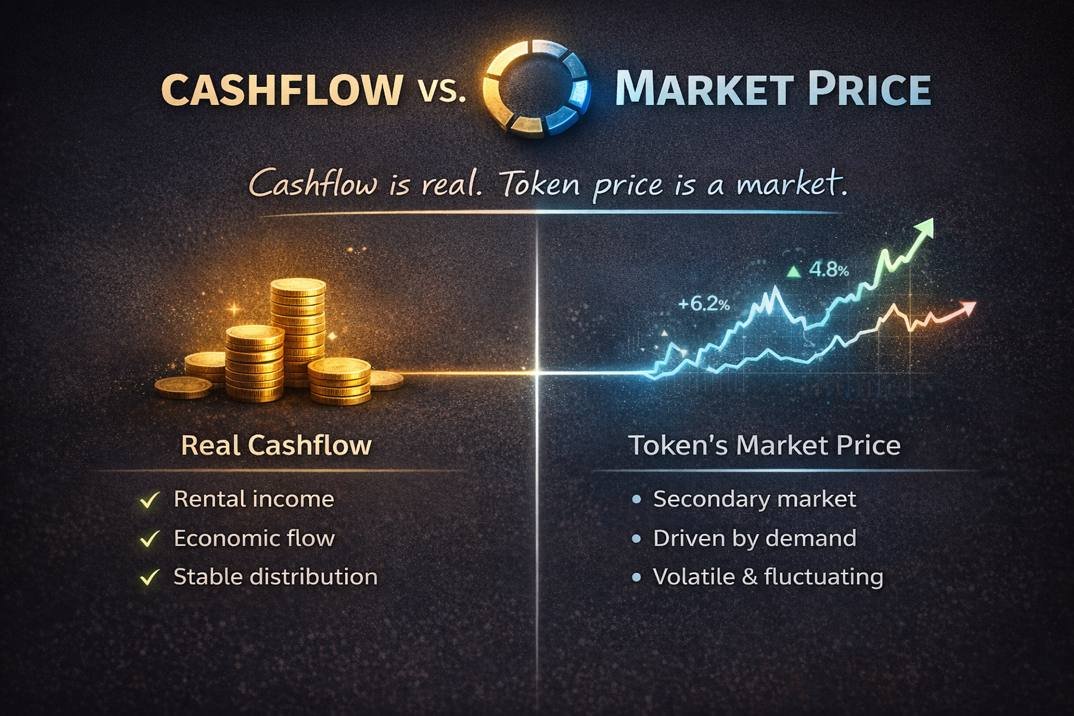

Cashflow is real. Token price is a market.

This distinction sits at the core of real estate tokenization — and it is often overlooked.

Many tokenization models focus on distributing income generated by real assets.

That income is real.

The assets are real.

But the token price itself is formed elsewhere:

on a secondary market driven by supply, demand, expectations, and liquidity.

Understanding this difference is essential for anyone who wants to make informed decisions.

This article is educational by design.

Its purpose is not to persuade, but to clarify.

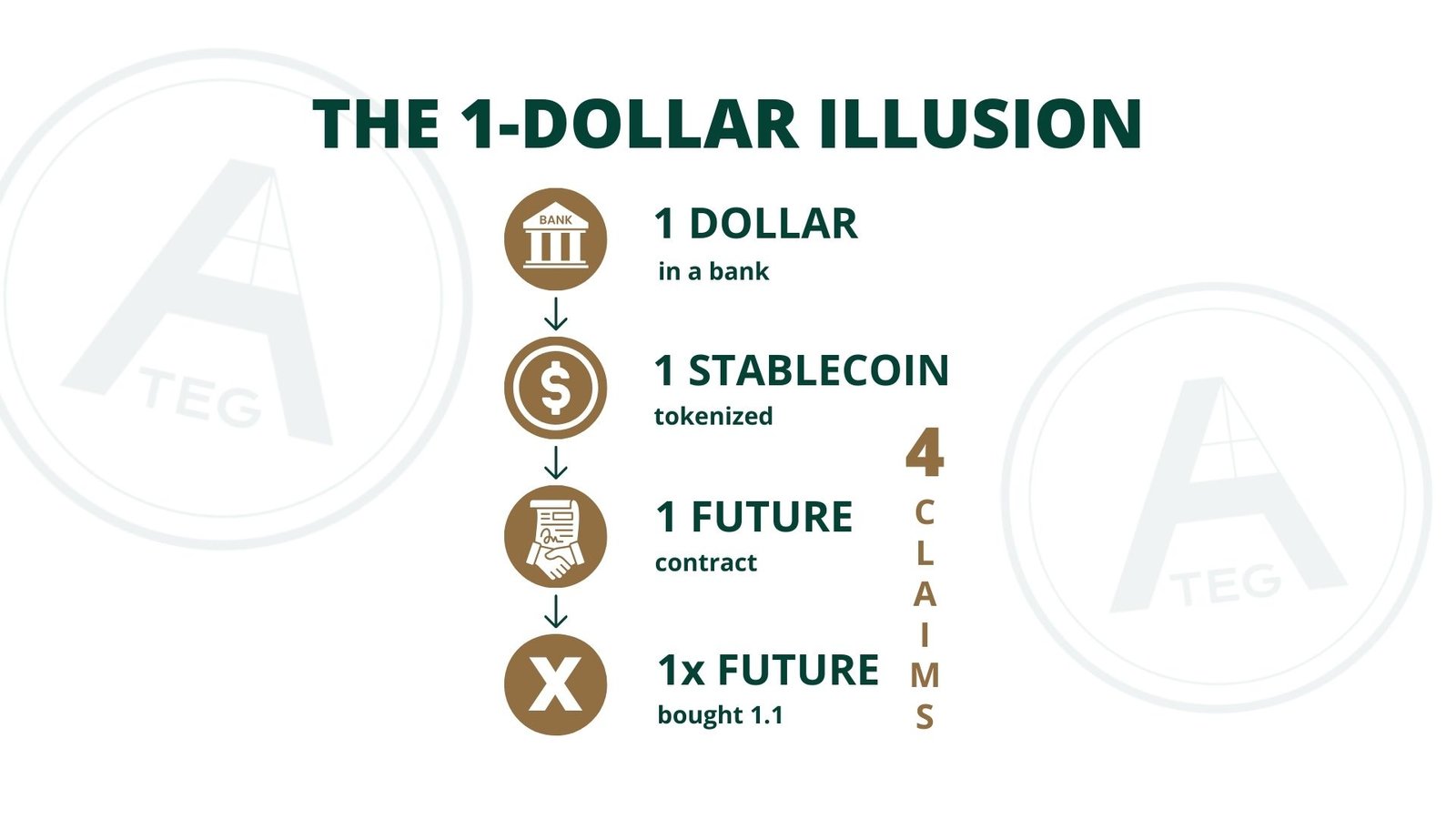

Cashflow and token price are not the same thing

In many fractional real estate tokenization models, the logic appears straightforward:

A property generates rental income.

That income is distributed to tokenholders.

Therefore, the token should increase in value.

In reality, these are two different layers.

Rental income is an economic flow.

Token price is a market outcome.

A token can distribute stable income while its market price fluctuates — or stagnates — depending on trading dynamics rather than asset performance.

This is not a flaw.

But it must be understood clearly.

Where does demand for the token come from?

Token prices are formed by buyers and sellers.

In many fractional ownership models:

- tokens are initially sold during a funding phase

- afterwards, they are mainly held by investors

- secondary trading happens largely among existing holders

In such a structure, price movements are often driven by:

- liquidity

- market sentiment

- short-term expectations

Trading activity can resemble demand,

but trading alone does not create structural demand.

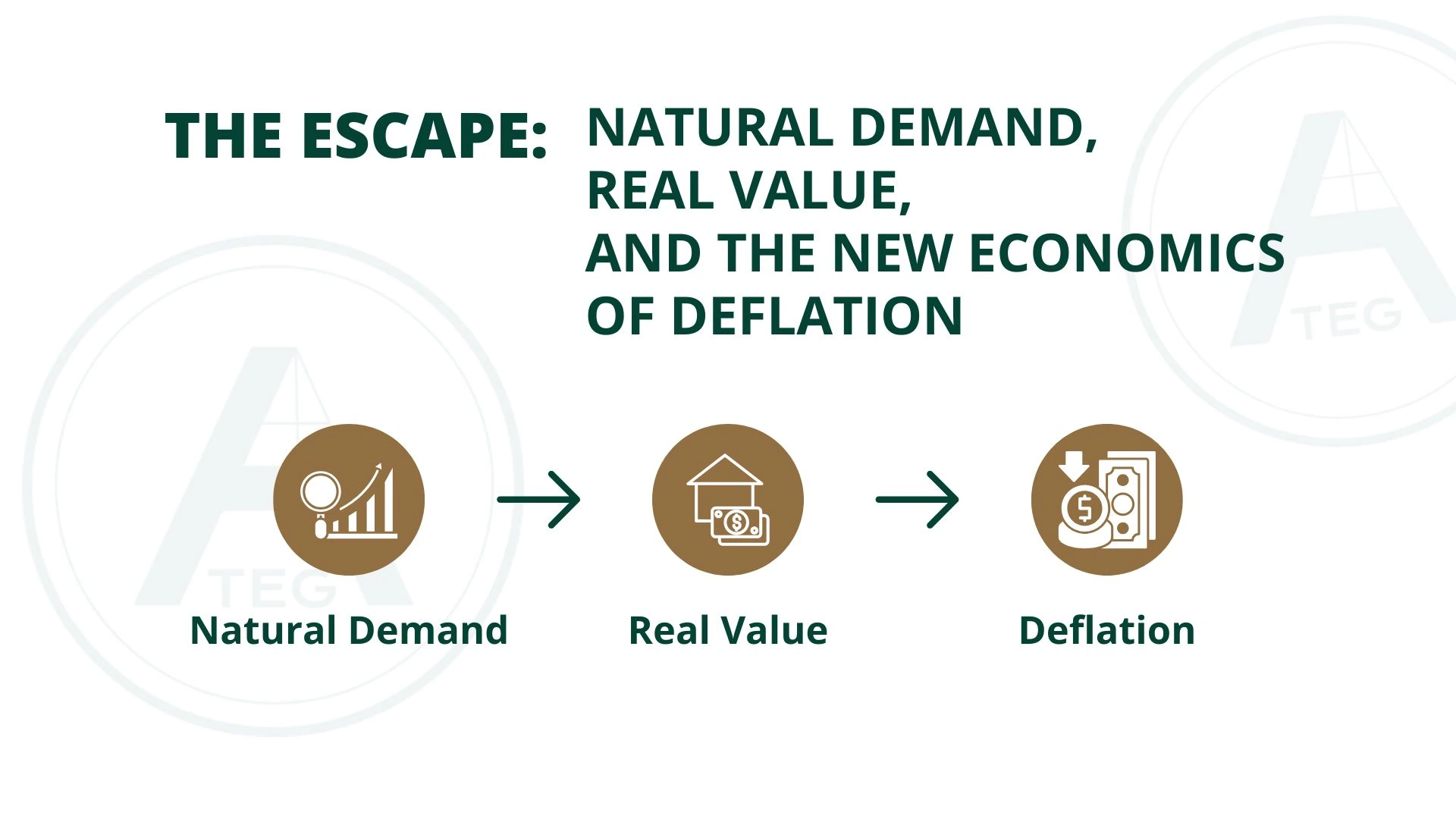

Structural demand usually comes from an external reason to hold or acquire a token — not merely from the expectation that someone else may buy it later.

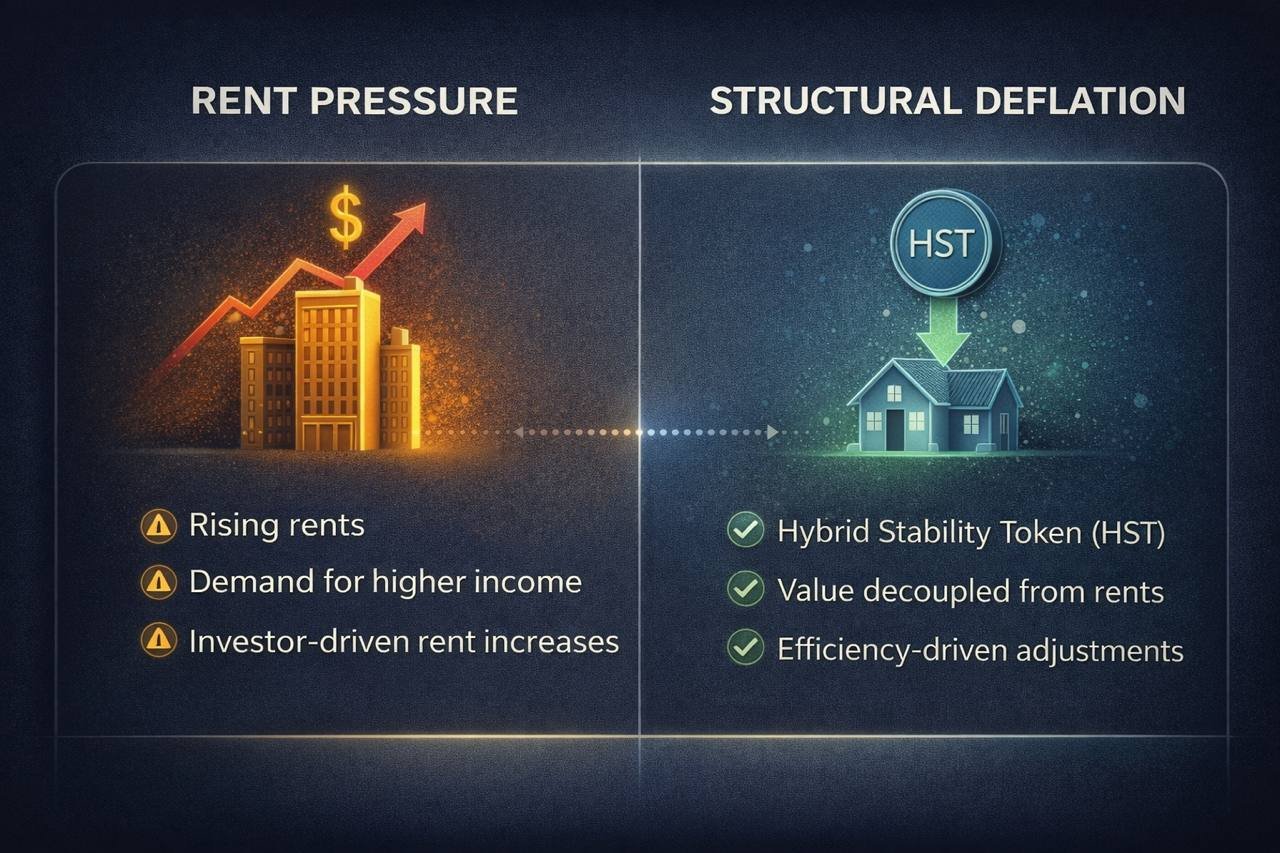

When does a real estate token gain value in a meaningful way?

There are valid drivers that can support value over time:

- the underlying asset becomes more valuable

- rental income increases sustainably

- operational risk decreases

- transparency and structure improve

However, these improvements only affect the token price if there is a clear connection between real-world performance and token dynamics.

Without such a connection, price movements may become detached from fundamentals.

Participation is not the same as price appreciation

Many real estate tokens function well as participation instruments.

They can:

- distribute income

- provide exposure to real assets

- offer access to otherwise illiquid markets

But participation alone does not explain why a token should become increasingly demanded over time.

If a token’s primary function is to be held and receive distributions, its price may behave more like a yield instrument than a growth asset.

This is neither good nor bad —

it simply requires realistic expectations.

Why this distinction matters

Confusion often arises when three different concepts are blended together:

- ownership

- income participation

- token price appreciation

Each follows different rules.

When expectations about price growth are not aligned with demand mechanics, disappointment is likely.

Education helps prevent that.

Our perspective at ATEG

When we started designing ATEG, we did not begin with the question of how to make a token attractive on the secondary market.

We began with a more fundamental question:

What creates real, continuous demand — beyond speculation and internal trading?

Clear separation by design

At ATEG, real estate and operational assets remain where legal and economic reality place them:

on the balance sheet of the operating company.

We do not attempt to replicate property ownership through tokens.

Instead, we consciously separate:

- legal ownership

- economic participation

- token mechanics

This separation creates clarity — legally, economically, and structurally.

From closed loops to structural logic

One of our core design principles was to avoid closed demand systems.

Closed systems are typically characterized by:

- tokens circulating mainly among existing holders

- prices driven by liquidity and sentiment

- demand dependent on others entering or exiting

ATEG was designed with a different focus.

Our model connects token dynamics to ongoing economic activity, not just to trading behavior.

The intention is not to promise price outcomes,

but to make value formation understandable and traceable over time.

Education before expectation

We believe participants deserve clarity.

Clarity about:

- what a token represents

- what it does not represent

- why it may behave the way it does

Education creates realistic expectations.

Realistic expectations create long-term trust.

For us, education is not marketing.

It is part of responsible system design.

Final thought

Tokenization does not fail because of technology.

It fails when people are not given the full picture.

Cashflow is real.

Markets are real.

Understanding the difference is essential.