Market influence is real — dependence is a design choice

No economic system operates in isolation.

Prices, sentiment, and liquidity affect all markets to some degree.

Claiming full independence from market cycles would be unrealistic.

However, being influenced by markets is not the same as being dependent on them.

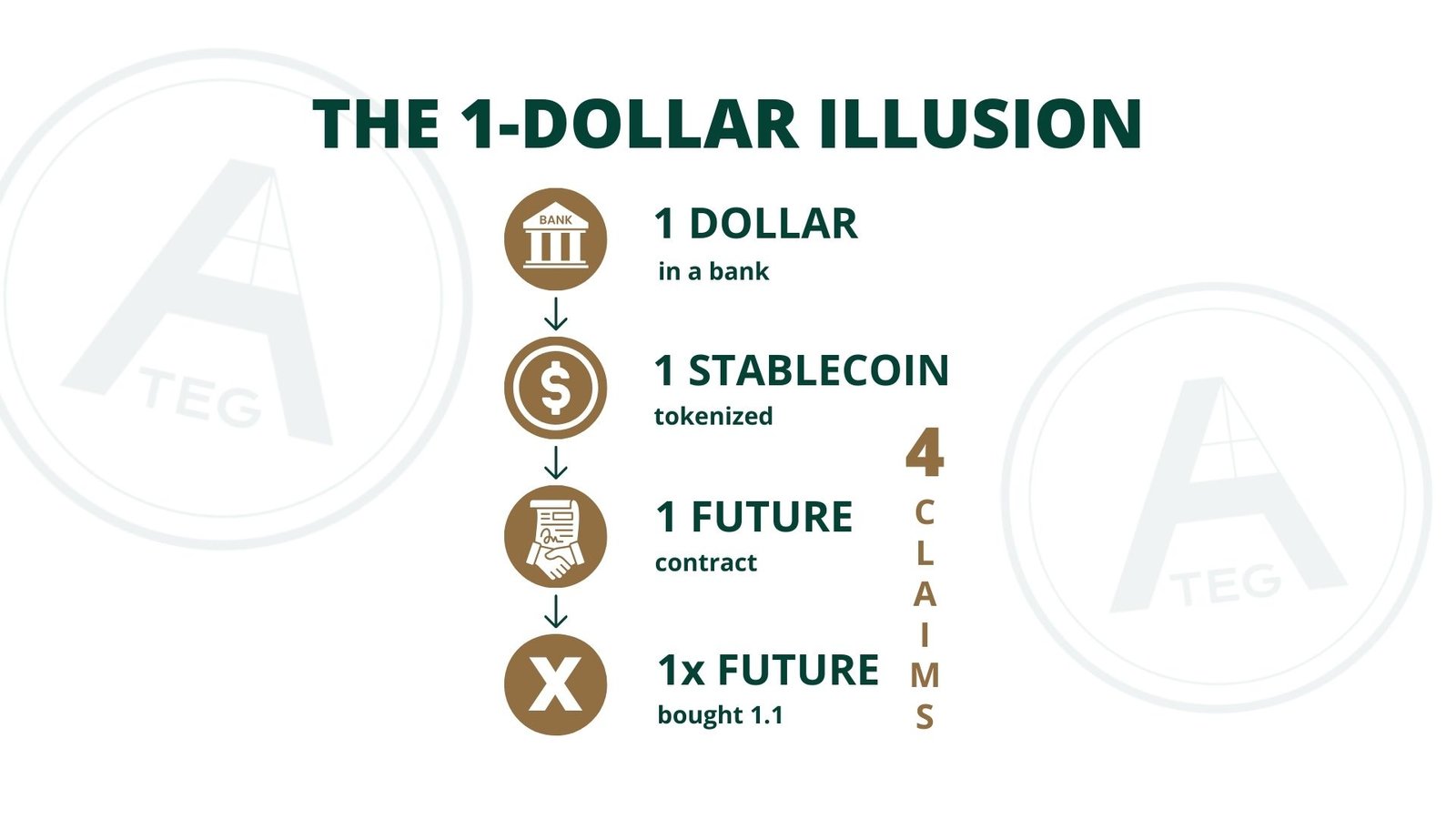

Many token models rely almost entirely on speculative demand:

- in bull markets, demand increases because prices rise

- in bear markets, demand disappears because prices fall

When sentiment fades, the system loses its primary source of activity.

This is not a flaw of markets.

It is a consequence of design.

Why ATEG was designed differently

ATEG was not designed to predict bull markets or to shield itself from bear markets.

It was designed to remain functional across different market phases.

The key difference lies in where demand comes from.

Instead of relying primarily on expectation-driven buying, the system is anchored in recurring real economic activity.

Housing is lived in.

Energy is consumed.

Monthly revenues continue — regardless of market mood.

Bull markets: growth as an opportunity, not a requirement

In bullish market environments:

- higher token prices can facilitate capital formation

- expansion becomes easier

- growth accelerates

ATEG can benefit from such conditions.

But crucially, the system does not require rising prices to operate.

Growth is treated as an opportunity — not as a dependency.

Bear markets: structure replaces sentiment

In bearish environments, speculative demand often collapses.

In many systems, this leads to a demand vacuum.

In ATEG, activity continues because it is not optional:

- real assets remain in use

- real revenues are generated

- predefined economic processes continue to run

Lower market prices do not stop the system.

They change how it responds.

With the same recurring economic input:

- more tokens can be absorbed from the open market

- supply-side pressure adjusts naturally

- interaction with the market remains active

This is not market timing.

It is structural behavior.

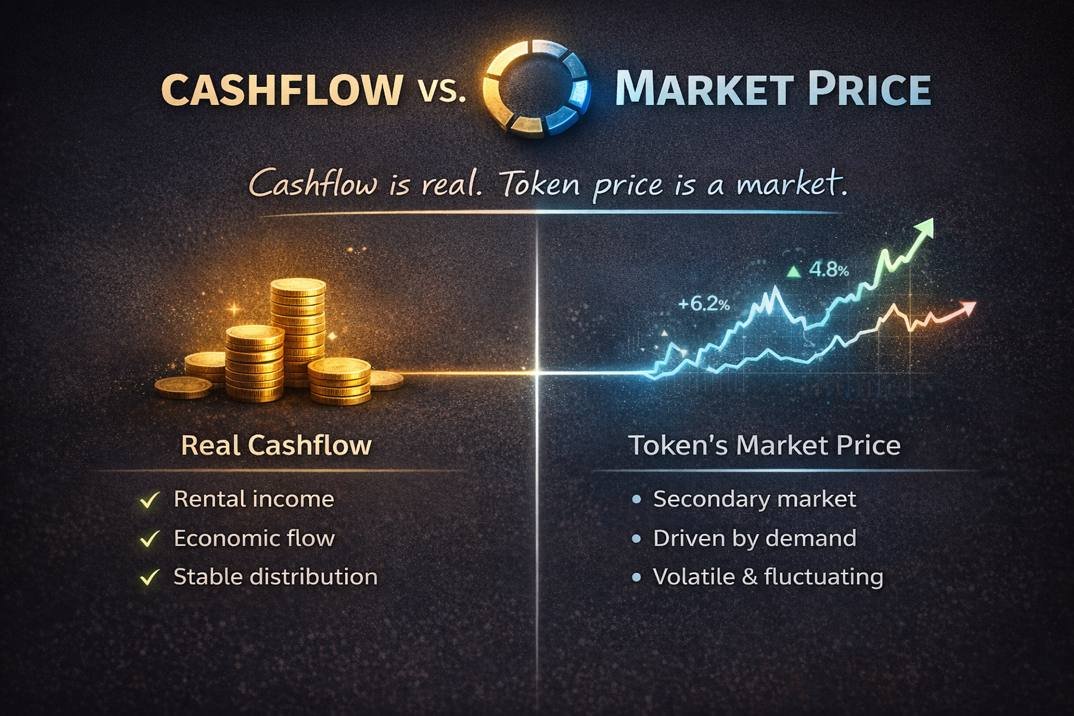

Structured demand instead of speculative pull

Speculative demand depends on belief and expectation.

It rises and falls with sentiment.

Structured demand is different.

It is tied to:

- ongoing economic activity

- predefined processes

- recurring cycles

In ATEG, this creates continuous interaction with the token system —

even when market sentiment is weak.

This does not eliminate volatility.

But it reduces fragility.

Resilience through structure

ATEG does not claim immunity from market cycles.

It was designed to work through them.

By anchoring token dynamics to real-world activity and recurring processes, the system aims to remain economically meaningful across bull, bear, and sideways markets.

Closing thought

Markets move in cycles.

Speculation follows emotion.

Structures follow logic.

ATEG was not built to chase market phases.

It was built to remain functional within them.