The triangle at the center of the model

The ATEG ecosystem is built around a three-part structure:

At the center is the real economy — housing and energy — operating in real markets.

Around it stands a triangle:

- ATEG as the operating company

- Residents, who live in and use the housing

- Token holders, who provide capital through tokenized participation

Each corner plays a distinct role.

None is replaceable.

None is excluded.

From tokenized crowdfunding to real assets

The process begins with tokenized crowdfunding.

When tokens are purchased, capital flows into the operating structure.

This capital is used to:

- acquire real estate

- develop or build housing

- create productive, usable assets

The token is therefore not an abstract instrument.

It is linked to the company that owns and operates real assets.

Residents are not external to the system

In many traditional models, residents exist outside the value logic.

They pay rent.

That rent is distributed.

Their role ends there.

We deliberately chose a different approach.

In the ATEG model:

- residents are users of the system

- residents are contributors to economic activity

- residents are also members of the ecosystem

Their rental payments are not treated as an isolated cashflow.

They are integrated into the balance-sheet-based economic cycle.

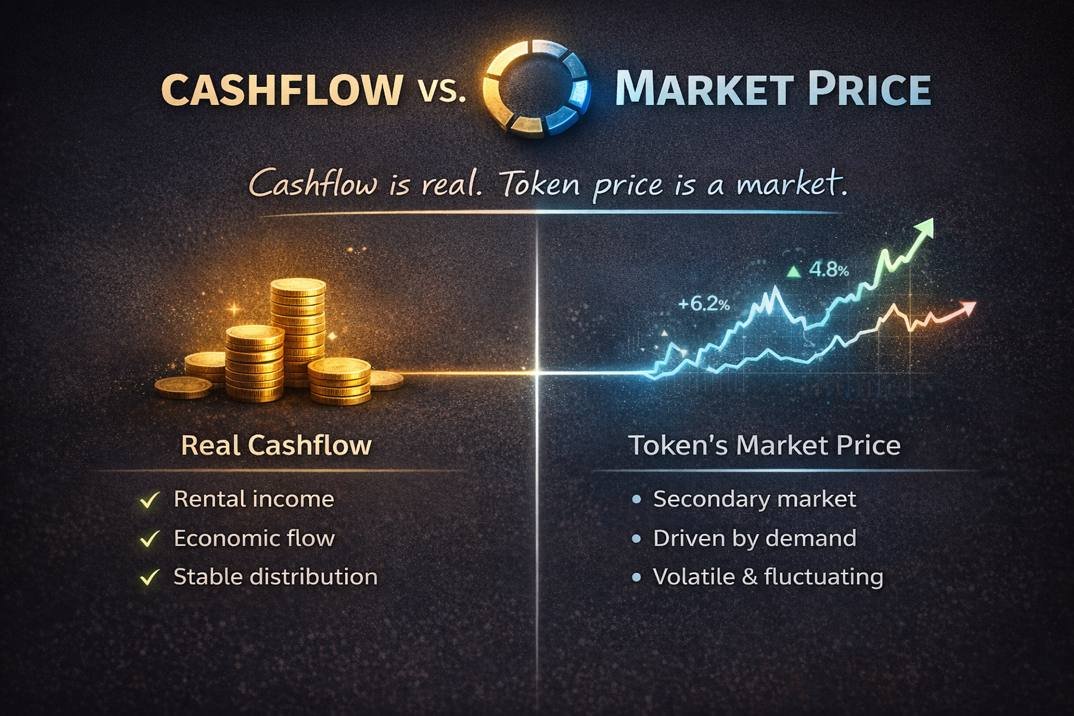

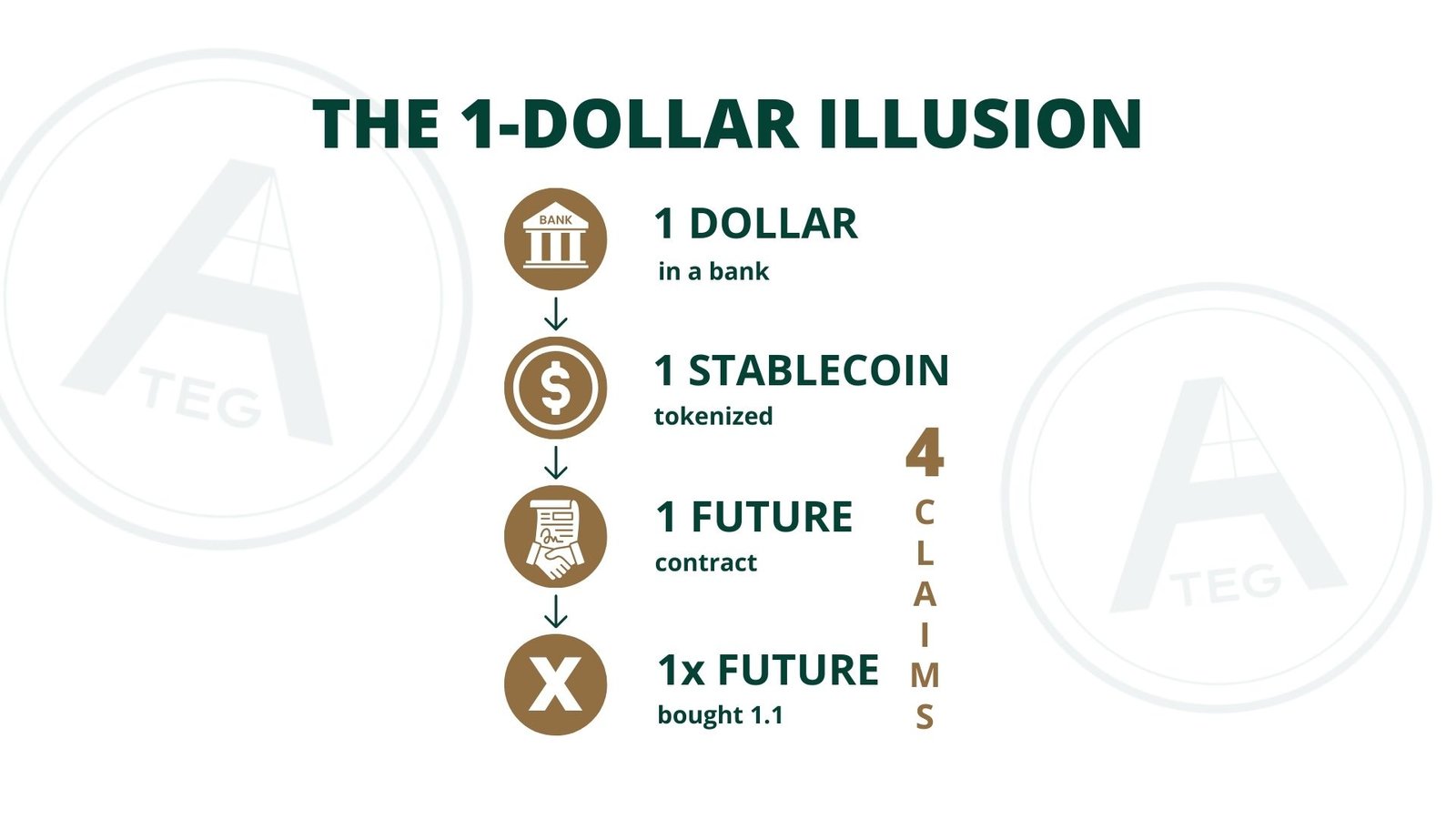

How value and price interact

Rental income flows into the operating structure and becomes part of the company’s real economic performance.

From there, it interacts with the token system through predefined mechanisms:

- balance sheet organization

- index-based valuation logic

- supply-side deflationary processes

This is where an important distinction becomes visible:

Some participants primarily create value.

Others primarily create price discovery.

Token holders provide capital and long-term alignment.

Residents provide real economic usage and predictable activity.

Both are necessary.

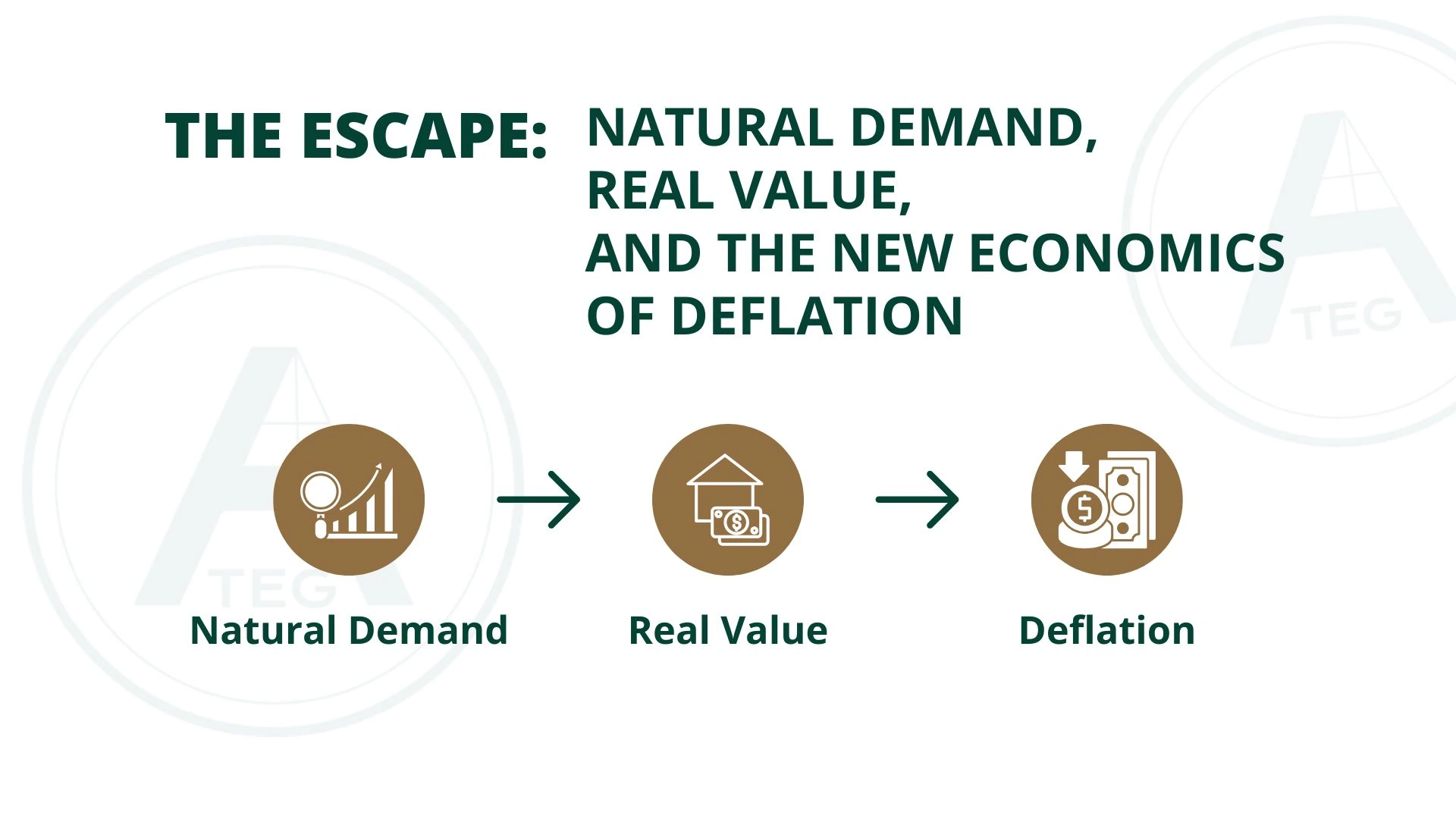

Natural demand through real interaction

When the market price of the token falls below the internal index level, the system can:

- buy tokens from the open market

- create natural, non-speculative demand

- reduce circulating supply through deflation

When the market price rises above the index level:

- internal mechanisms adjust supply

- tokens from existing reserves are reduced

- excess is structurally absorbed

At the same time, residents themselves can interact with the system:

- buying tokens when market prices are low

- using them within the ecosystem

- paying in fiat when prices are high

In both cases, activity leads back into the same economic loop.

One system, different roles, shared outcome

This is why we do not separate “investors” and “users” into isolated silos.

One group enables access to capital.

The other enables real economic function.

One creates value.

The other enables price discovery.

Neither exploits the other.

Neither exists without the other.

Both are members of the same ecosystem.

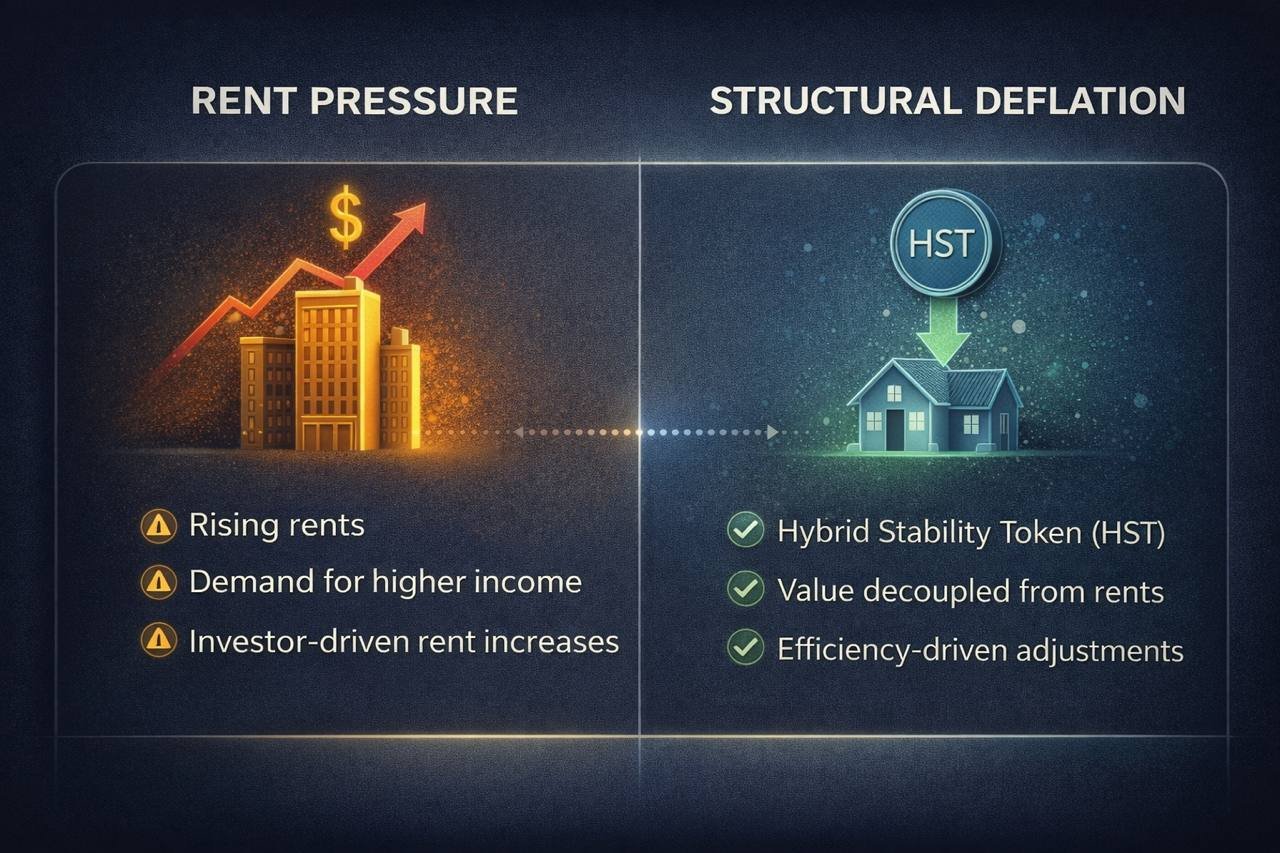

Why inclusion matters

By including residents rather than excluding them, the system gains stability.

Housing affordability and value creation are no longer opposing forces.

They become part of the same structure.

The goal is not to extract maximum rent.

It is to create a sustainable cycle where:

- real assets are built

- people can live affordably

- economic activity feeds back into the system

- and value emerges through structure, not pressure

Closing perspective

ATEG was designed as an ecosystem, not a transaction.

It works because:

- capital is connected to real assets

- residents are part of the value logic

- token dynamics are linked to economic reality

One hand does not wash the other.

The system works because all hands are connected.