Rent as an economic signal

In traditional housing systems, rent performs a very specific role.

It transfers value in one direction:

- from residents to property owners,

- from monthly cashflow to extracted profit.

This structure is not accidental.

It is the result of decades of financial design where housing became an asset first and a living space second.

As a consequence:

- rents rise over time

- purchasing power erodes

- dependency increases

- and residents remain permanently exposed to inflation

This is not a moral judgement.

It is a structural observation.

The core question

If rent is one of the strongest recurring cashflows in the economy, why should it disappear from the system after being paid?

Why should it not contribute to stability, resilience, and long-term value?

At ATEG, this question led us to rethink the relationship between living, revenue, and value creation.

A different approach: structure instead of extraction

ATEG is building a living and energy ecosystem supported by a crypto-asset architecture.

The model integrates:

- real estate operations

- renewable energy revenues such as photovoltaics and electricity generation

- and a token system designed to interact with real economic activity

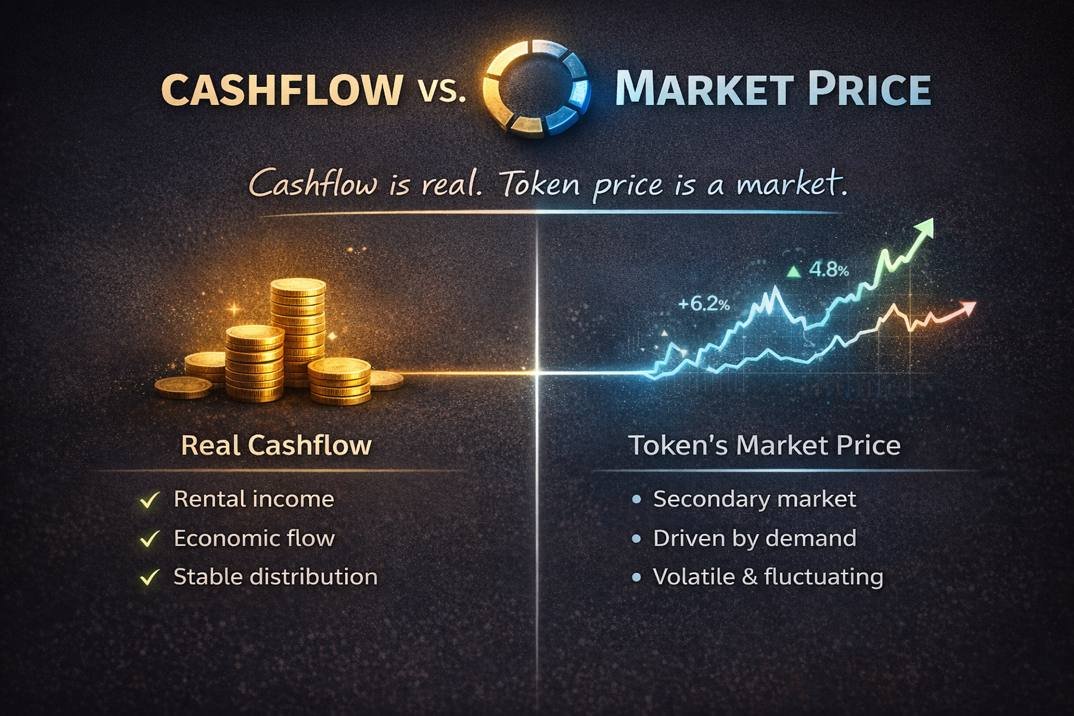

The key difference lies in how revenues are treated.

Instead of extracting rent as terminal profit, parts of the cashflow are structurally reintegrated into the ecosystem.

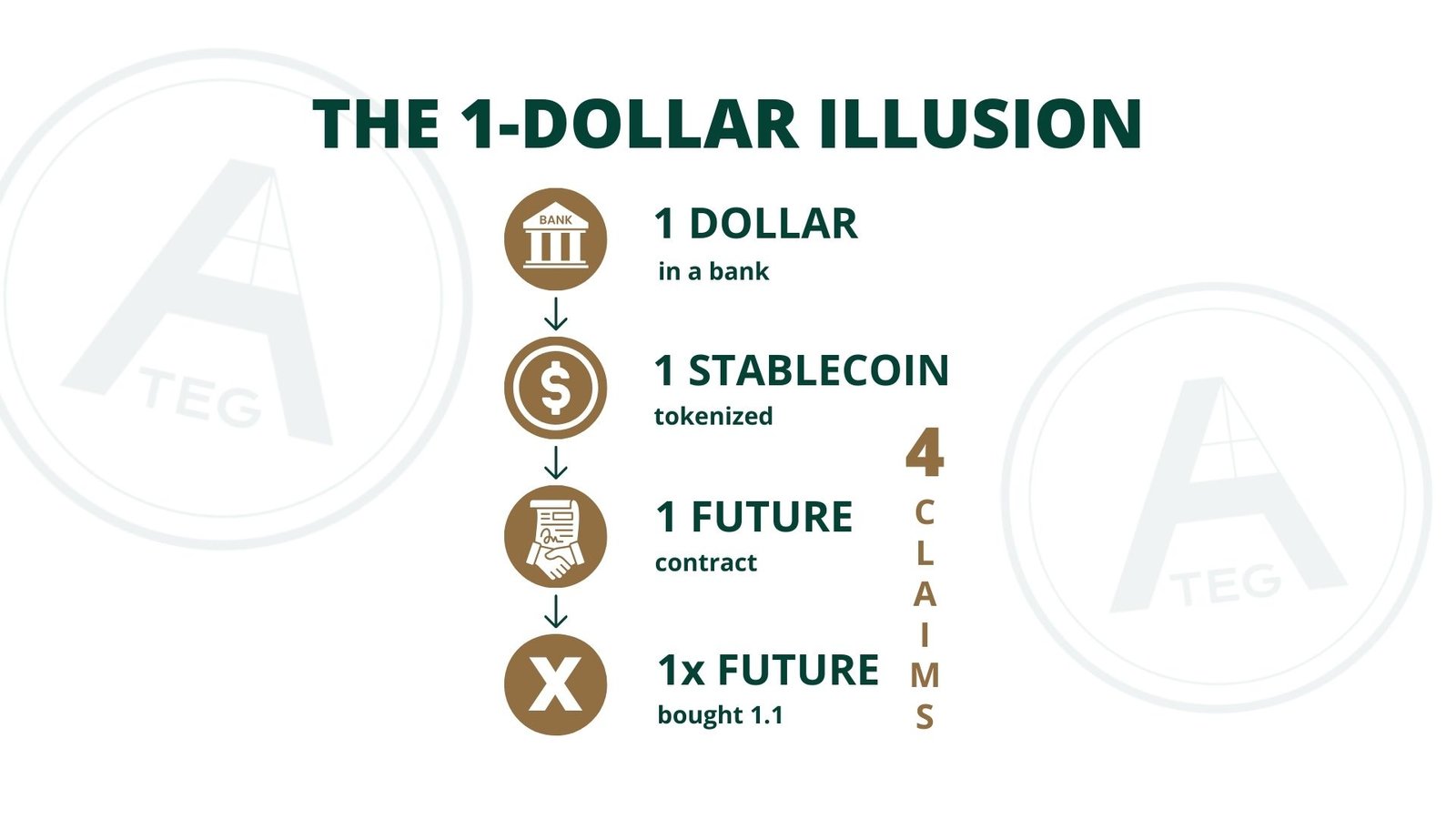

This reintegration connects real-world revenues with a token architecture that follows a dual deflation mechanism:

burn and freeze.

The objective is not short-term appreciation.

It is long-term structural stability.

Two roles, one shared system

The ATEG ecosystem is supported by two complementary roles.

Tokenholders

Tokenholders contribute capital that enables housing projects, energy infrastructure, and the expansion of the operational model.

They provide the initial momentum.

They build the foundation.

Residents

Residents are not treated as passive tenants.

Their monthly payments are not designed solely for profit extraction.

Instead, these payments become part of a wider economic loop.

Through reintegration into the ecosystem, residents indirectly support:

- value stabilization

- token supply reduction mechanisms

- and the long-term resilience of the system

In this sense, residents are not only users of the system.

They are contributors to it.

This is why we describe the relationship as follows:

- Tokenholders build the ecosystem.

- Residents keep it alive.

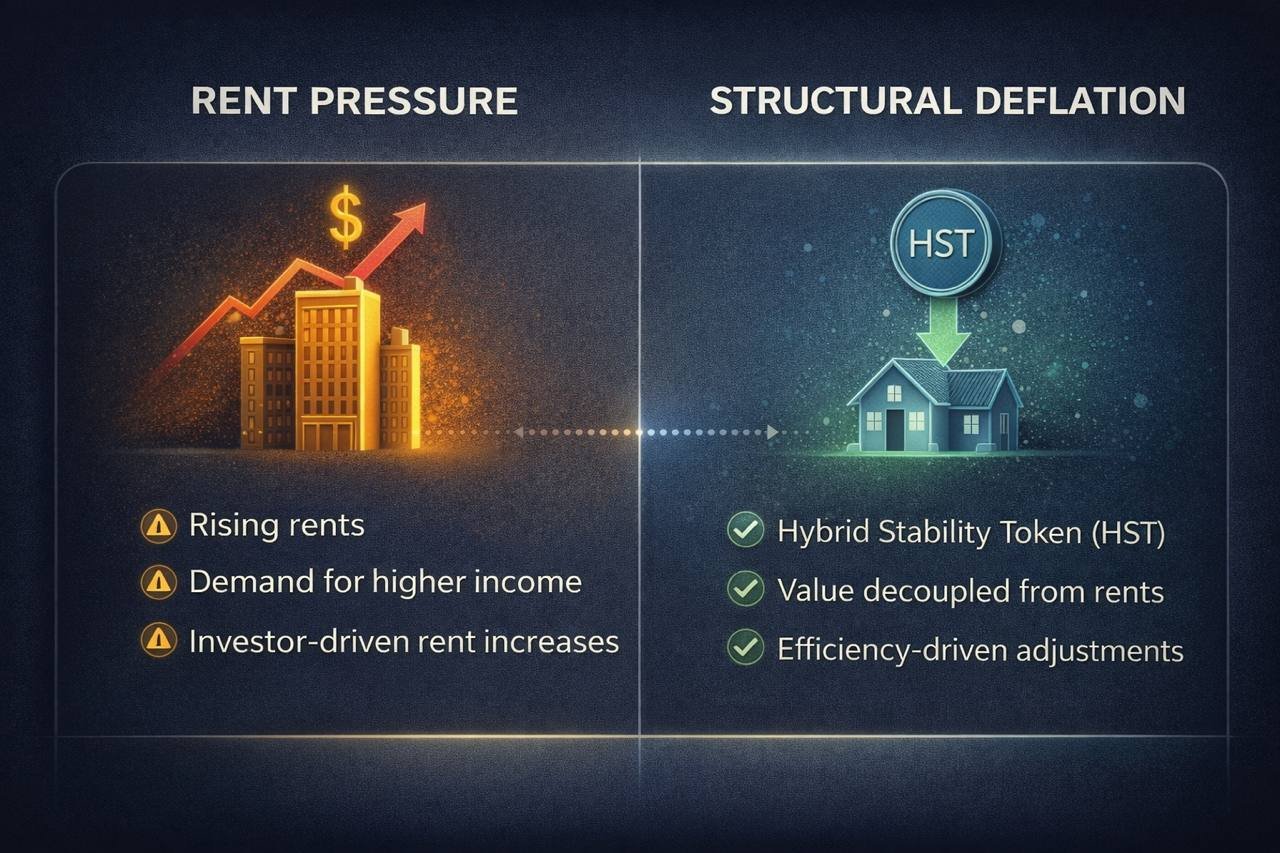

From inflationary pressure to structural deflation

Traditional housing models amplify inflation.

Costs increase while purchasing power declines.

Rent follows inflation upward, often faster than wages.

The ATEG model is designed to counter this dynamic structurally.

By connecting real revenues to a system with controlled supply reduction, inflationary pressure can be partially absorbed by deflationary mechanics within the ecosystem.

This does not eliminate economic cycles.

But it changes how their impact is distributed.

Instead of pushing all pressure onto residents, the system itself begins to absorb part of the load.

Why this matters beyond housing

Housing is not just a social issue.

It is an economic signal.

When living becomes unaffordable, societies do not fail emotionally.

They fail structurally.

ATEG does not claim to solve housing alone.

But it proposes a different logic:

- Living should not only consume value.

- It should help create stability.

A shift in perspective

If rent continuously rises, it is not fate.

It is design.

And design can be changed.

ATEG is built on the belief that:

- real value should be connected to real activity

- economic systems should reward contribution, not dependency

- and long-term stability matters more than short-term extraction

This is not about disruption for its own sake.

It is about responsibility in system design.

Closing thought

Rent only appears neutral

when its role in the system is not examined.

ATEG exists to examine that role and to redesign what comes after.