Tokenization with Real Purpose

Our model is built on three unique financing mechanisms:

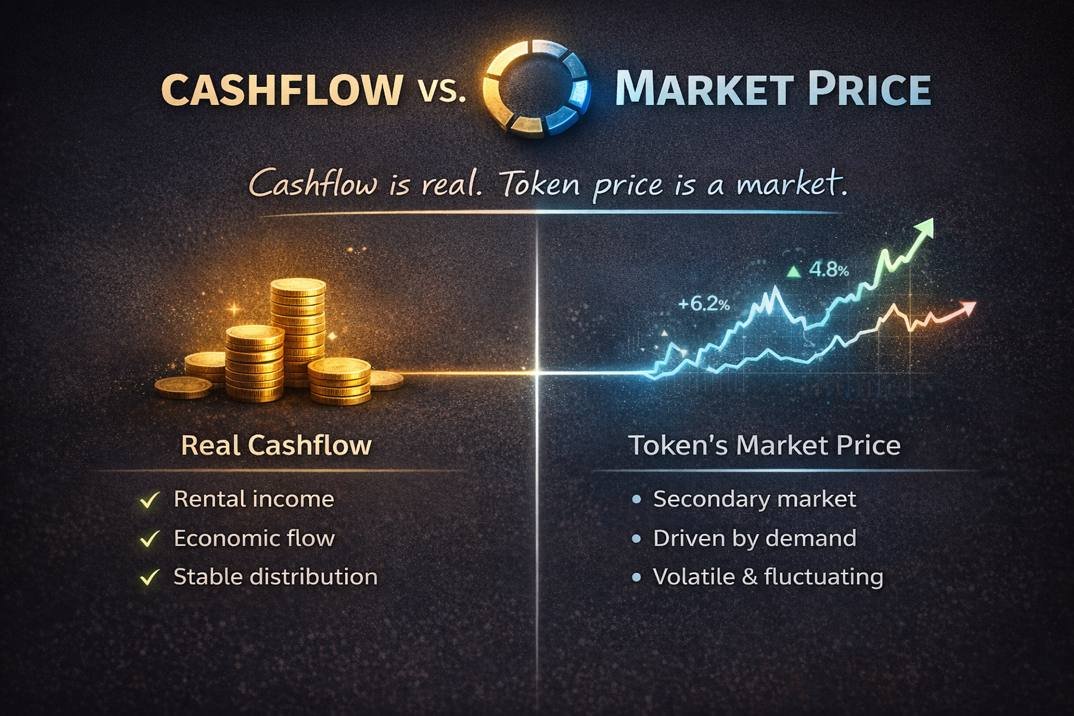

- Crowdfunding tokenization: digital participation in real estate projects for investors of all sizes.

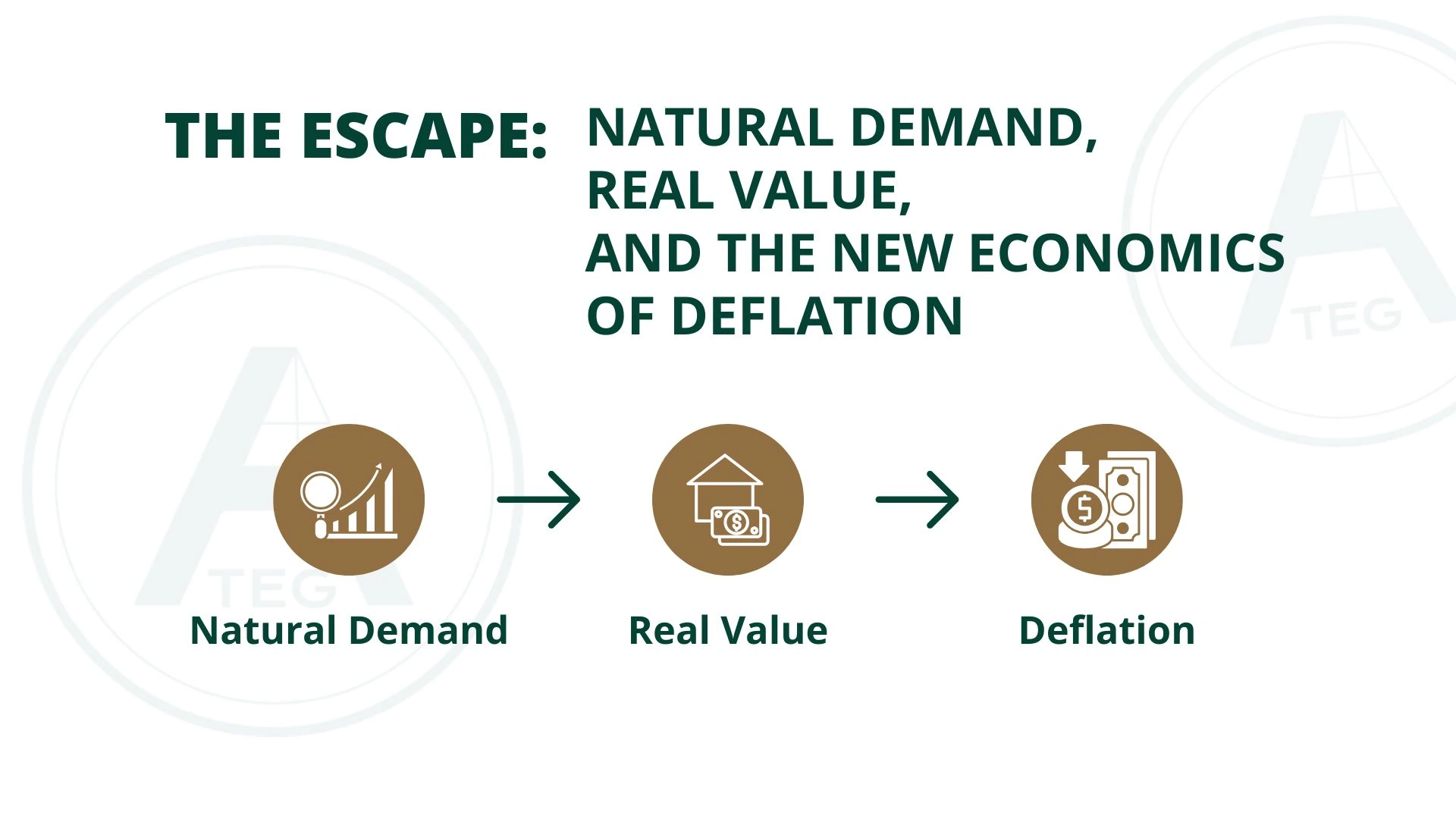

- Balance sheet tokenisation: revenues from real estate projects are tokenized and sustainably reinvested.

- Dual deflationary system (Freezing & Burning): tokens are temporarily frozen or permanently destroyed to secure long-term value.

Result: investors not only benefit financially, but actively support a model that promotes affordable housing.

A System for Investors & Society

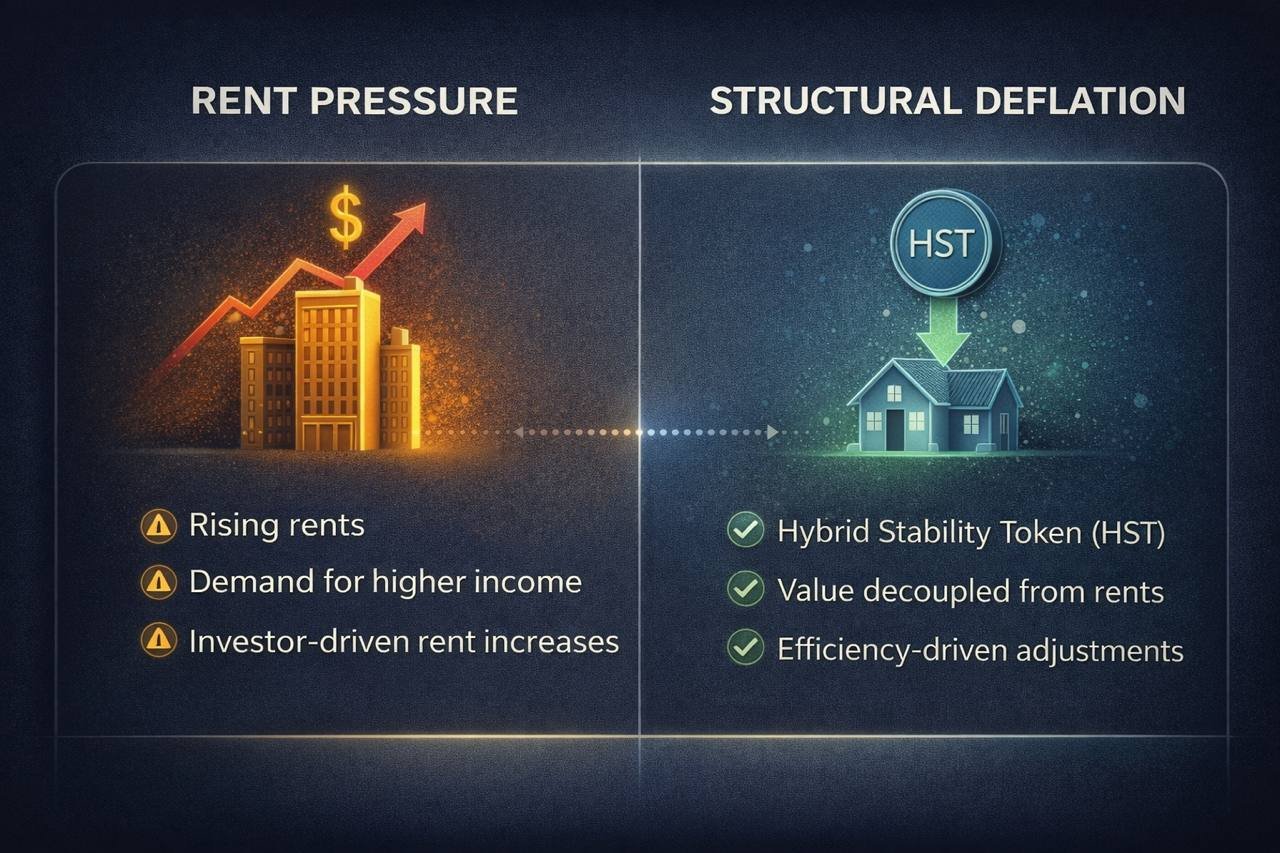

- Housing remains affordable – our token mechanisms prevent speculative price spikes.

- Transparency & fairness – blockchain ensures secure and traceable investments.

- Social responsibility– tokens that were temporarily frozen can be released for sustainable housing projects.

Invest with a clear conscience – a financial model that moves not only money, but also helps people.

Three Asset Classes in One Model

ATEG Capital FlexCo merges digital financial innovation with real-world assets and already covers three of the six largest asset classes:

- Real estate as an asset class – stability & real value.

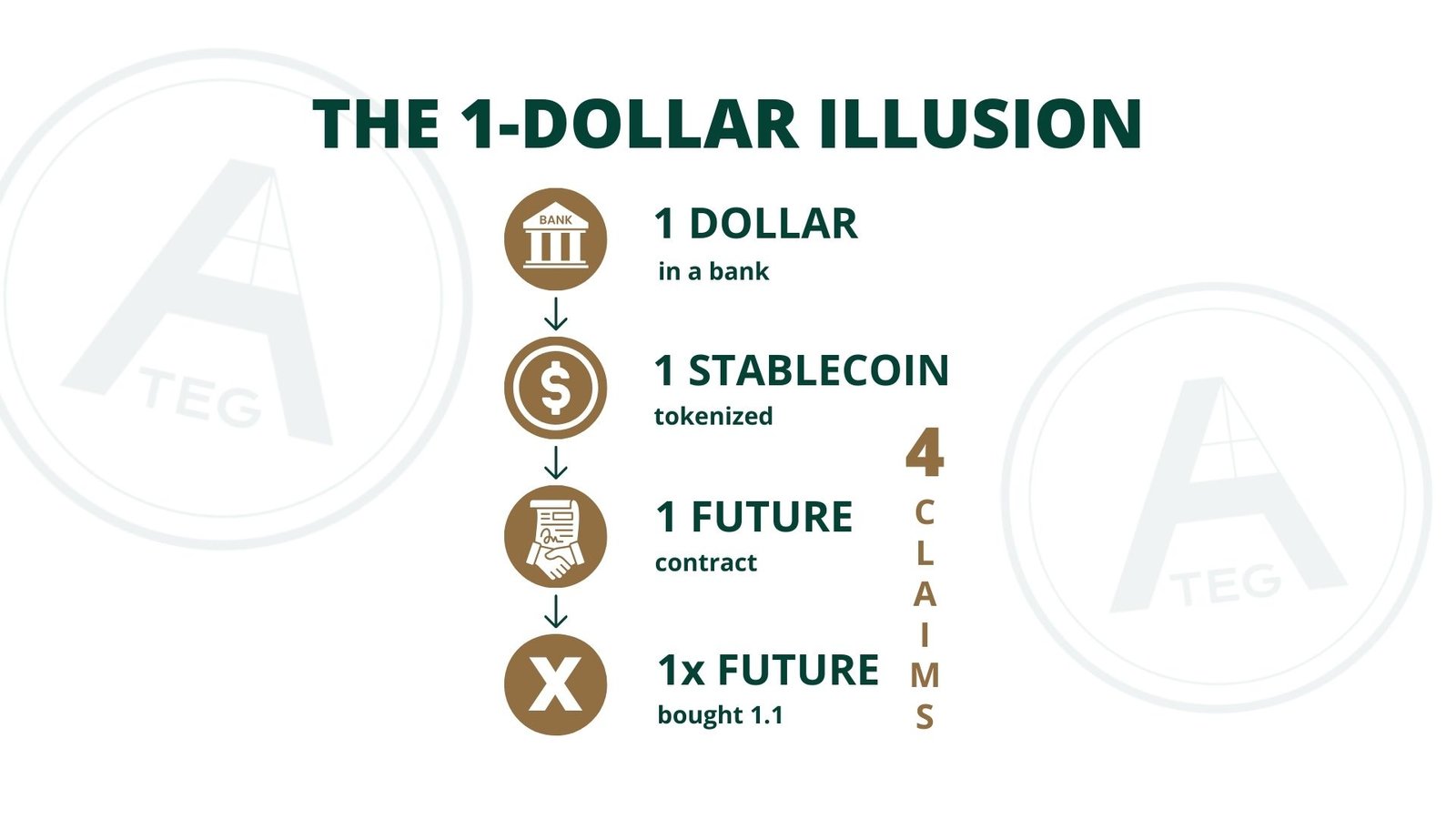

- Cash reserves as an asset class – liquidity & security.

- Digital assets as an asset class – blockchain for efficiency & scalability.

An investment model with long-term value growth & societal benefit.

Conclusion: Shaping the Future Instead of Speculating

We believe that real estate financing should be more than just profit maximization – it should also create socially sustainable solutions.

- Investors benefit from a stable, innovative financial model.

- Housing remains accessible and affordable for everyone.

- Capital flows not only into digital loops but strengthens the real economy.

ATEG Capital FlexCo connects crypto, real estate & social responsibility – for a better future.